新入荷

再入荷

900グローバルエタニティ14ポンド

タイムセール

タイムセール

終了まで

00

00

00

999円以上お買上げで送料無料(※)

999円以上お買上げで代引き手数料無料

999円以上お買上げで代引き手数料無料

通販と店舗では販売価格や税表示が異なる場合がございます。また店頭ではすでに品切れの場合もございます。予めご了承ください。

商品詳細情報

| 管理番号 |

新品 :16533228172

中古 :16533228172-1 |

メーカー | 4fff8b33ddea | 発売日 | 2025-04-06 17:27 | 定価 | 7200円 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

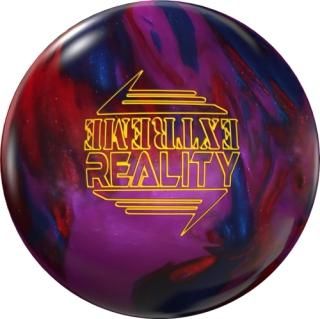

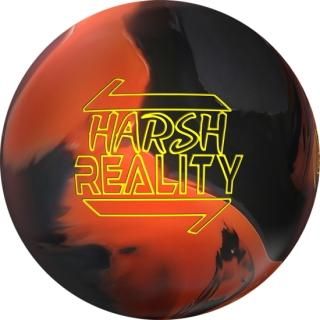

900グローバルエタニティ14ポンド

![エタニティ [900グローバル] 特価28,000円(税込) ボウリングボール・用品の専門店プロショップベガ通販 エタニティ [900グローバル] 特価28,000円(税込) ボウリングボール・用品の専門店プロショップベガ通販](https://img06.shop-pro.jp/PA01112/543/product/172770208_o2.jpg) エタニティ [900グローバル] 特価28,000円(税込) ボウリングボール・用品の専門店プロショップベガ通販,

エタニティ [900グローバル] 特価28,000円(税込) ボウリングボール・用品の専門店プロショップベガ通販, Amazon.co.jp: 900 Global Xponent 14ポンド : Sports & Outdoors,

Amazon.co.jp: 900 Global Xponent 14ポンド : Sports & Outdoors, 900グローバル - N&KプロショップP1【公式通販】 ボウリング用品・ボウリングボール 国内最大級の品揃え!,

900グローバル - N&KプロショップP1【公式通販】 ボウリング用品・ボウリングボール 国内最大級の品揃え!, 900グローバル - N&KプロショップP1【公式通販】 ボウリング用品・ボウリングボール 国内最大級の品揃え!,

900グローバル - N&KプロショップP1【公式通販】 ボウリング用品・ボウリングボール 国内最大級の品揃え!, 900グローバル - N&KプロショップP1【公式通販】 ボウリング用品・ボウリングボール 国内最大級の品揃え!

900グローバル - N&KプロショップP1【公式通販】 ボウリング用品・ボウリングボール 国内最大級の品揃え!