Before I start with the review, I just want to leave a short note on the fast development and improvement of Tastyworks. I have to edit and update this review constantly because the Tastyworks team is constantly adding so many new great features. 2022 will be an amazing year at Tastyworks. I have seen their plans and upcoming features and all of them are very promising. So if a feature seems missing to you, chances are high that they will implement it later down the road.

Tastyworks is a regulated and very new broker from the same very experienced creators of the broker Thinkorswim. Tastyworks is not your average trading broker, it is a very special broker. This does not necessarily mean that it is the best choice for you. Tastyworks is also the broker that I currently use for my trading. I will present you the reasons why I like Tastyworks in the following Tastyworks brokerage review.

Tastyworks Video Review And Tutorial

If you prefer watching videos over reading articles, you could check out my video review of Tastyworks’ platform. In it, I cover the same topics as I do in this written review.

Click HERE To Sign Up To Tastyworks!

Features

Let us begin with the standard features of brokers: the range of investment products. Tastyworks offers stocks, options, ETFs, futures and options on futures. Nothing special here. Tastyworks offers cash accounts, margin accounts, corporate accounts, trust accounts, international accounts, retirement accounts and joint accounts/custodial accounts are coming soon. There is no minimum deposit for cash accounts. But to use margin in a margin account, you will need at least $2000 in your account. Therefore, it is reasonable to deposit at least $2000 to earn margin privileges.

Tastyworks offers very clean, fully customizable and easy to use charts. For these charts, Tastyworks offers 100 different indicators to choose from and all of these can have custom settings as well. Additionally, they have 20 different drawing tools to choose from. All of these technical analysis features are fully customizable to fit every individual. But all of this is fairly standard for a good broker.

The next really great feature on Tastyworks that I love, is their watchlists. By default, Tastyworks has 11 different preset watchlists to choose from for now (Positions, Notable Stocks, High Options Volume, Live on Tastytrade, Tastytrade Futures, Liquidity, Tastytrade Stocks, Market, Tom’s Watchlist, TastyTrade Default, Upcoming Earnings). These preset lists are great for different purposes. For example, a watchlist displaying assets with high options volume can really be helpful (for an options trader).

Normally watchlists found on other broker platforms just seem to be some random securities in a list. But the preset lists aren’t even the best part in my opinion; the ordering/filtering mechanism is. All lists can always be ordered by many different filters. For example, you can filter for the biggest move, Bid/Ask price, liquidity, volume… but best of all IV Rank. In options (especially in my strategy) implied volatility (IV) is very important. It can make the difference between losing and winning.

IV Rank shows you how high implied volatility for a certain asset is compared to earlier IV for this asset. In other words, it shows you if implied volatility is high or low. Many brokers don’t even have IV Rank at all. But the fact that you can order stuff from highest IV to lowest IV is so incredibly helpful for option traders. It will allow you to find high IV assets with 1 click. Just to give you some perspective: Optionalpha, an option trading website offers a paid watchlist with the main feature being sorting by IV Rank (The watchlist is great). So people normally go to websites and pay money just to do this. The fact that Tastyworks has included this is awesome. Option traders will love this.

For instance, I as an option trader, can now just choose the preset watchlist ‘High Options Volume’, filter from highest IV Rank to lowest resulting in a long list of potentially profitable trades. The same cost me money and so much more time before I used Tastyworks. Of course, you can also create your own, custom watchlists and filter these.

In general, I would say that Tastyworks has many great features, especially for option traders. They have more or less normal and simple option chains that you of course also can customize for your personal needs. By default, you have volume, the probability of profit, Bid/Ask price, expiration date, and strike displayed. But you can change that and add many different readings. Directly under the option chain, you can see the options that you selected and all the statistics for those (probability of profit, delta, theta, standard deviation, P/L, implied volatility, the expected move, max profit/loss, exp date/s, strike/s, price). This makes it very easy to analyze your potential position. Additionally, you can and just/change the options directly from the option chain or the order menu below. This makes setting up and analyzing orders very easy and fast.

In addition to the option chain, Tastyworks also offers a cool, more appealing alternative. They have this interactive payoff curve, wherein you can select/adjust/change different stock or option positions. This directly shows you how your changes affect the payoff. This is good for users that want to have a good alternative or addition to the option chain, but I am glad that they still included a normal chain.

Recently the Tastyworks team added an Analysis feature to their trade tab. The Analysis feature allows you to analyze existing and potential positions in many different ways. The feature has too many options, to be described in a brief paragraph. Therefore, I added the following video. It is a walkthrough of the Analysis feature. Even if you don’t watch the whole thing, you should get a pretty good idea of how the feature works.

Don’t be worried if the Analysis tab seems intimidating and complicated at first. You will get used to it while using Tastyworks. The Analysis feature is a great way to visualize potential price changes, risks and rewards that occur when certain market conditions change. I will definitely incorporate this feature into my trading.

In a recent update, yet another interface was added. This one is called Active and it is built for the active trader. It allows you to order and manage mainly stock (and futures) positions with extreme ease and speed. This makes Tastyworks attractive for stock traders, but the interface is even more useful for futures traders.

Another good feature for option traders, especially for less advanced traders are the preset strategies. Directly on the option chain (or the curve), you can choose from 20+ different option trading strategies, like vertical spreads, iron condors, strangles, straddles, calendar… This and the great adjustment features are great for beginners or just lazy people that don’t want to set up the strategies by themselves.

Moreover, Tastyworks has a tab called ‘Follow‘. In that section, Tastyworks displays all the recent trades of their successful veteran traders. The date, reason, P/L, and much more are displayed for every single trade. If you like one or more trades, you can choose to copy that exact trade. All of these can also be filtered for different criteria.

An additional tab inside the Tastyworks trading platform is the ‘Tastytrade‘ tab. If you didn’t know, Tastyworks is created by the Tastytrade team. Tastytrade is a huge financial network that tries to educate its viewers/readers about the market and especially about options. In the ‘Tastytrade’ tab, you can watch Tastytrade either live or older videos. You can also access their market research with their market outlooks for different assets.

Additionally, Tastyworks has amazing support for any problems. If you have a minor question or problem, there is a huge library of questions accessible straight from the platform itself. If you can’t get your question answered there, you can always choose to ask your question in the live chat. The support team typically responds straight away.

All of the features discussed above are available either on the Tastyworks web-based platform or on the downloadable program. The platform, in general, is very clean and easy to use and navigate. It is not set up in a complicated manner at all. Even beginners should have no problem at all. Furthermore, Tastyworks now does offer a mobile app from which you easily can trade and manage your positions on the go. This Tastyworks app is very useful as it makes you much more flexible. It is available on both IOS and Android.

And finally, I want to name a few upcoming features to get you excited about Tastywokrs bright future: Portfolio Margin, Paper Trading, Open API, New Scripting Language, Many New Mobile Features and more… All of these features really are something to look forward to. I personally am especially excited to check out the new scripting language.

Make sure to check out my ultimate tastyworks tutorial to learn more about the platform.

Pricing

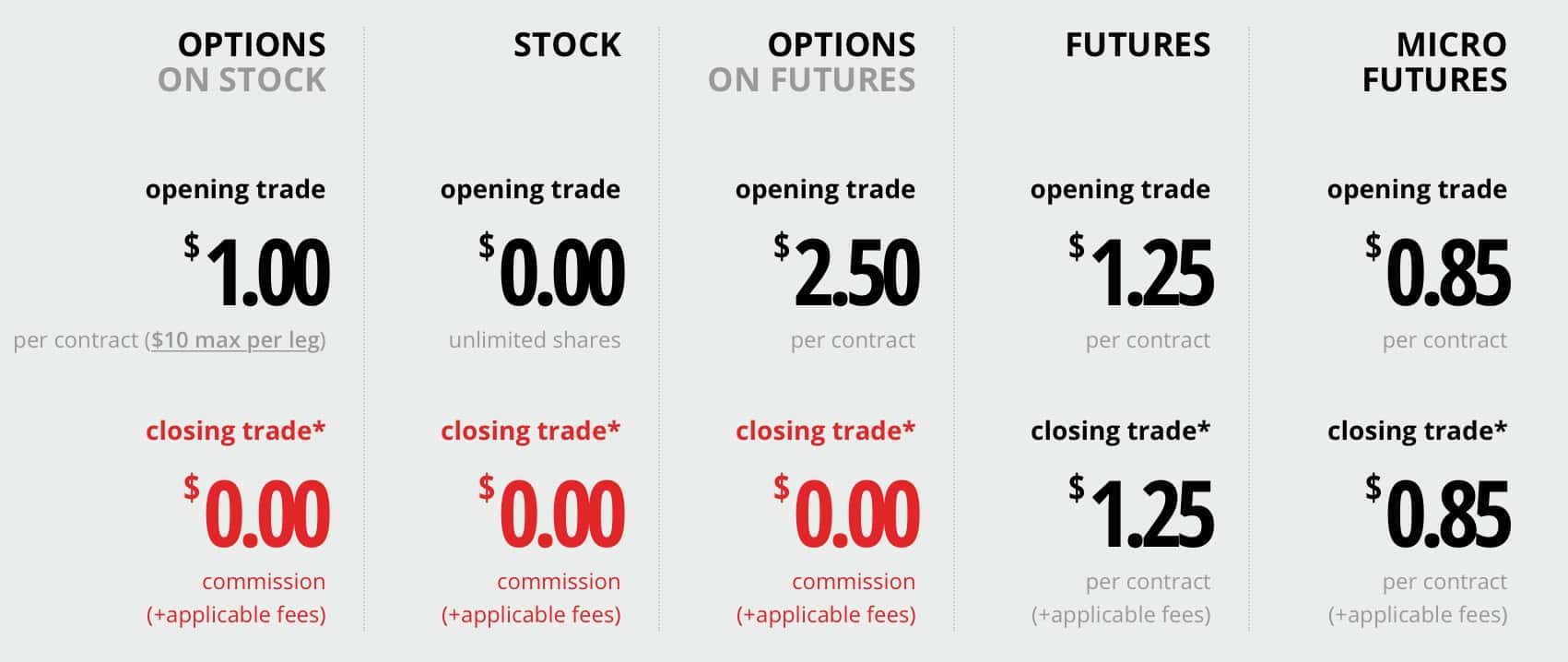

Pricing is one of Tastyworks biggest strong points, especially when it comes to options. They completely blow every other brokerage firm that I know out of the water. There is no comparison. Even otherwise very cheap broker firms, can’t hold up with this. First of all, there are no base rates at Tastyworks. Secondly, their initial commissions are very low. And finally, they have no commissions on closing trades. I have never seen any other broker do this.

Commissions for options are $1 per contract (again with no base rate). I prefer option commissions that are per contract over those that are per order because this gives you more flexibility when ordering.

Tastyworks’ stock commissions are even better than their option commissions! That’s because there are none. Yes, that’s right, Tastyworks does not require you to pay any commissions when trading stocks, regardless of how many shares you trade! (Note that there still will be a small clearing fee of $0.0008 per share which is standard at all broker firms).

The low commissions are especially great for beginners and traders with smaller accounts. Often commissions can eat up the small profits made in smaller accounts. In Tastyworks, you can trade very small positions and still make money. This is not the case for many other brokers. But traders with bigger accounts will definitely enjoy the low commissions as well.

Commissions on futures and on options on futures are extremely competitive as well. As you can see below, you have to pay $1.25 per futures contract both when opening and when closing the position. Options on futures require $2.5 per contract to open and $0 commissions to close.

When it comes to pricing and commissions, Tastyworks is BY FAR the best and cheapest broker that I know of.

But we are not done yet with commissions. In 2019, Tastyworks launched their next commission modification: capped commissions. Yes, that’s right. Now there is a maximum you can pay in commissions on options trades. That maximum is a staggering $10 per leg. Here are some examples to show you the actual impact of such a cap:

- 100 Puts or Calls (one leg) normally would have cost you $100 in commissions alone ($1 per contract). Now the exact same trade would cost you $10 in commissions. Already $100 aren’t a lot compared to other brokers, but $10 for such a position really is revolutionary.

- 200 Credit Spreads (two legs) would have cost you $400 ($2 commissions per spread). This and other spreads with two legs is now capped at $20 in commissions. I don’t know what to say more…

- 100 Iron Condors (four legs) would have set you back $400 in commissions alone ($3 per Iron Condor). Such a spread is now capped at $40 in commissions which really is very low for 100 Iron Condors or any other 4-leg spread.

Before concluding this review, I want to add another note on Tastyworks’ commission structure. In 2019, other firms have also started offering low or even no commissions on their stock trades. This, however, often comes at a cost in some other areas. Other cheap brokers often have unreliable, slow, and, in general, slow trade executions. From experience, I can say that this is not the case for Tastyworks. Even though they offer extremely low commissions, they don’t slack on their trading infrastructure or other aspects.

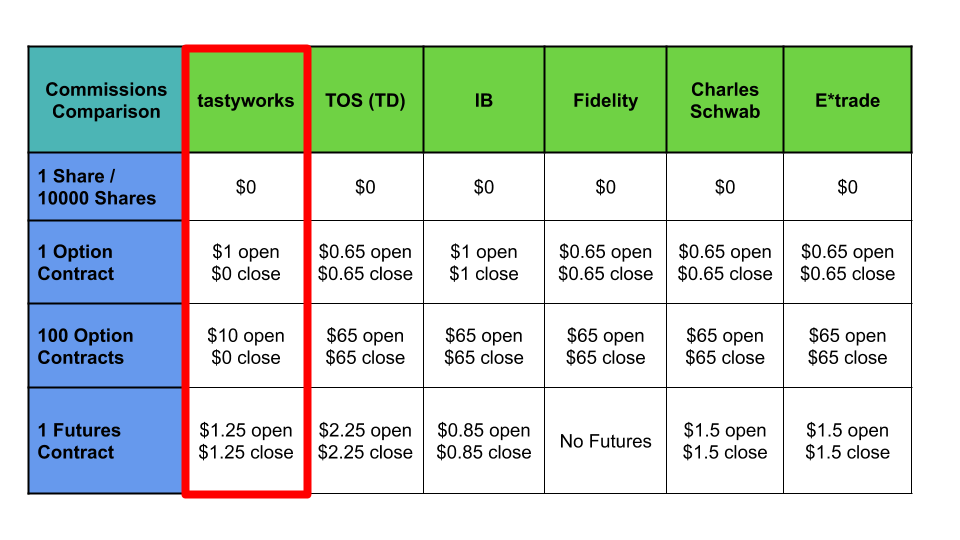

On the following table, you can see that, when it comes to options, tastyworks is the cheapest choice among these brokers. (Note that non-trading commissions such as clearing fees aren’t taken into account here.)

Conclusion:

As Tastyworks has changed so much over the past few weeks/months/year, I had to re-write my conclusion over and over again. But just to show you how my conclusion changes, I want to keep one of my older conclusions for you:

“As you probably have guessed by now, Tastyworks is a broker designed for option (and futures) traders. Tastyworks is a paradise for option traders. It has the best pricing/commissions that exist, near perfect software and features (for option trades). You can really notice how the trading platform is built for an option trader, all the features are exactly what an option trader needs. Things that once took ages now can be done with a few clicks. As the creators are option traders by heart, they also know what an option trader wants and needs. The creators use Tastyworks themselves and that is also why the whole platform revolves around the user. They built an amazing platform for themselves and anyone like-minded. Tastyworks is more or less perfect for an option trader. But if you aren’t an options trader and don’t want to use all the features that they offer, Tastyworks is probably not for you. Tastyworks is really only for option traders and not for any stock traders or anything else. You can trade stocks with them, but the features will be limited.”

As you see, I really enjoyed the Tastyworks platform already, but in my opinion, it was only really suitable for the options trader and not anyone else. Now I feel that this has changed. I still don’t think Tastyworks is for a super-advanced stock trader that needs tons of crazy advanced features. But if you want to trade some stocks based on some charting or similar ‘normal’ analysis, Tastyworks is definitely a great choice. The extremely low commissions, upcoming features, amazing customer support and more aren’t only attractive to options or futures traders anymore. Stock traders can definitely benefit from Tastyworks.

Even though Tastyworks is still relatively new, they are already available in most countries. They are constantly updating and improving their platform by adding new features and more. In the course of the past few months, Tastyworks has changed and improved a lot.

Bonus Offer: Get $200

If you are reading this before the end of August of 2022, you can get $200 in stock as a signup bonus if you open and fund your account with at least $2000.

Click HERE to Open a Tastyworks Account!

Some of the links within this Tastyworks review are referral links of which I may receive a small compensation. There are no added costs for you and these referral links do not influence the objectivity of my review.

Hopefully with the upcoming promising improvements this will continue to be very useful with decent support, Value is delivered in a product like this when the creators are virtually given to always upgrading the features to make it better and give its users something extra for the same price. Hope to see continued improvements.

Me too Andrew! But I am very sure that the TastyWorks team won’t stop constantly updating and improving the platform. I will try to keep this review up to date as well.

Thanks for introducing Tastyworks. Tastyworks is a broker designed for option traders.

I just clicked the link you have and have a look on its platform. I really like its watchlist screen. It is very clear when I compare it with the one from Interactive Brokers. It is designed by traders so that it fits into what I want to have.

Besides, the commission are lower than Interactive Brokers. With better functions and usability, I will open a new account and try their service.

Your article helps me a lot. Thank you.

You are welcome Nico!

The watchlists on Tastyworks are one of my favorite features! They really are great. Additionally, the commissions are the lowest that I have ever seen for a good broker. You will surely enjoy Tastyworks. If you have any trouble signing up or later, just send me a quick message and I will be happy to help.

thank you for exposure to Tasty Works. I never heard of it before. How long has it been around? It seems from your review that it is perfect for options traders. When I have traded options, the commissions are a killer…amazing that they do not charge on the out. And they still give all the tools so needed. I appreciate the lead!

Glad that I could help you. Tastyworks is still a fairly new broker. I am not completely sure since when they exist but it’s definitely not longer than very few years. This doesn’t mean that they aren’t as good as others. The creators of Tastyworks have created other very successful broker platforms (like thinkorswim). So they are very experienced and use the experience and features from some of their former creations.

Thanks for all the research and detail you put into this! Good knowledge. I’m very new to this – I have an account with Ameritrade. I did some reading about it, but do you know if this is a good one?

Also, do you know of a good exchange to buy and sell cryptocurrency? There’s a ton of information out there about it, I’m finding it a little overwhelming.

Hey Jordan and thanks for the comment.

It depends on you and your trading style. Tastyworks is especially good for options and futures traders. But they are pretty good for ‘normal’ stock trading as well. Ameritrade is a good all-round broker as well even though they are a little more expensive than Tastyworks.

Sadly, I don’t know enough about cryptocurrencies to really help you out. I am not really involved with any cryptos up until this point.

Hmm I did not heard about this trade option before. Its platform looks nice, I might give it a try, but does it accept all countries? It is maybe confusing for begginers or overhelmed, but experianced traders will know how to use it. Great info! Thank you, I know my friend will love it, because he enjoy in these traders.

Hey, thanks for the comment.

Tastyworks is already available for many countries and more are added regularly. You don’t need to be an experienced trader to understand the platform. It is set up very simple especially compared to other broker platforms. Even beginner traders shouldn’t have trouble navigating and using the platform. Otherwise, there are countless (video) guides to help you. You can find some guides HERE.

is there any who one you could recommend for a trade manager louis.

Thanks for the comment. I have no experience with trade managers, so I can’t give you any recommendation. I am sorry.

For options trading I love Tastyworks. I have used E-Trade, OptionsXpress (purchased be Schwab), Trademonster (Purchased by Optionshouse and then by E-Trade) and now Tastyworks. I moved to Tastyworks from Optionshouse a year ago due to the E-trade acquisition. Tastyworks platform is fast and has all the info an options trader needs to make quick decisions on entering/exiting positions. There are not many bells and whistles compared to other platforms but they are adding new features regularly. I am looking forward to advanced orders…such as OTO orders that execute an options trade based on a stock price, etc. I liked the analysis tools that were on the optionshouse platform so am looking forward to some of these features in 2018.

Thanks for sharing. I couldn’t agree more!

“There are not many bells and whistles compared to other platforms” … Uh, WHAT??

I recently opened a Tastyworks account due only to the options pricing which saves me a few $ per round trip on small orders. I’ve quickly concluded that it ain’t worth it.

I’m a long time user of Optionshouse (now Etrade) and TradeKing (now Ally) and find those platforms (legacy OH and TK Live) FAR superior to the overproduced mess provided by Tastyworks. In fact, I absolutely hate the Tastyworks platform, which is so full of useless bells and whistles that it is practically unusable. It’s like they hired a bunch of overeager millennials, punch drunk on red bull, and said ‘have at it!’.

Please, just give me a quick and easy way to check greeks, oi, vol, and specify a position, with a profit/loss graph to verify I didn’t screw anything up, before hitting Send. And if I want/need to trade at work during the day, I don’t need a web trading platform that ramps my CPU and kicks the fan into overdrive, triggering every surveillance alarm in my employers command center.

I’ll close my account soon and move back to OH/TK where the bling is far more under control.

First of all, thanks for posting your opinion.

I really have to disagree with you on this one. I have used Optionshouse/Ally before myself. In terms of the number of features, these platforms have many more (to appeal to a larger target group). In my opinion, no trader needs all these features and that makes some features somewhat confusing and unnecessary. Tastyworks is a very niche broker platform. It is designed for (high probability) options trading. The creators of Tastyworks (Tastytrade) are very well known traders in this field. All the implemented features serve a purpose for this trading strategy.

I also find Tastyworks platform setup very basic. There are very few tabs that should be quite easy to navigate/understand. Compared to most other broker platforms, this is very beginner friendly. There are three main tabs: positions (open positions), trade (options chain, payoff curve, analysis option), activity (trade/order history). Otherwise, you can also view an asset’s chart, view watchlists… Nothing complicated, weird or useless here… Furthermore, all the most important and relevant information is always viewable at the top of the platform.

Again, Tastyworks has far fewer unnecessary features than other platforms as it mainly focusses on options trading.

Every broker platform comes with a learning curve. After time you get used to your broker platform. Therefore, trying out new platforms often is hard as you have to get used to a new layout/design.

I haven’t had any problems with the web platform either. You can also check positions on their Android/IOS app or use the web-based platform on the phone. Therefore, I don’t really see a problem checking positions during work.

My recommendation for you would be to give Tastyworks a little more time and another chance. Ideally, you could check out some of Tastytrade’s Videos to learn more about their way of trading options with Tastywork’s platform.

Very good information for someone that is thinking about getting into trading Options. After looking it over, I would recommend it to anyone looking for a good Options Trading Platform and I don’t think a person will find cheaper commission fees.

As I am older now, I need the security of Bonds and Dividend-paying stocks. My ole heart can’t take the excitement of Options Trading, but I will recommend it to anyone looking. Best to You

Wayne

Thanks for the great comment Wayne. I really appreciate it.

Even if you aren’t into options, you can use Tastyworks as a broker. You can trade stocks, ETFs… as well (with very low commissions). Furthermore, options don’t have to be much more volatile and exciting than stocks. There are just as conservative options strategies as there are stock strategies. Just make sure to get some good education on options before you start trading them.

Hi Louis,

Any suggestion on the best platform to buy commodities (like shares) for long term? I am not experienced to do options however given the current situation thinking of investing I commodities and keep them for a while.

Hi Sajid,

Commodities can be traded in many different forms. But probably the most common way to trade commodities is through futures. Futures are a different type of derivative. But I wouldn’t recommend trading futures if you are just starting out.

Instead, you could invest in commodities through Exchange-traded funds. For instance, the ETF GLD can be used to get exposure to Gold, SLV for silver, XLE is an energy ETF that gives you exposure to oil… These ETFs can be traded pretty much like normal stocks.

Most brokers allow you to trade these ETFs. So if you want to trade them (or futures), I still recommend tastyworks.

Thanks Louis, Gold I am good with as my bank allows to buy virtual gold that sit in the account and I can cash anytime. I bought most of mine below 150 USD so its nearly good time to cash and than buy Energy. Does the value of Energy ETF same as value of crude oil, etc?

Hi Sajid,

Depending on the ETF, you will gain different exposure to the energy sector. This will automatically also expose you to oil prices. But there are other products that could give you more direct exposure to oil.

I hope this helps.

Let me first say this: what a great educational page. I am not a trader, so my comments will reflect a non-trader view. I learned a lot, but some of the information is over my head. I think these are technical trader talk, so I don’t think there anything wrong. The page provides everything to the reader… features, prices and your opinions. Nice

Hi Louis, really cool and interesting post here. I have never heard of tasty works before, but it seems like it’s a pretty cool and handy broker platform to have. I’m already watching videos of how it works. There are so many functions. It’s a bit like photoshop just for trading 🙂

Great analogy! Tastyworks really is a great broker with a wide variety of great features. Nevertheless, it still isn’t hard to understand and use.

Does tastytrade show Prob. ITM for options?

Tastyworks doesn’t only show the probability of expiring ITM, they also show the probability that an option strategy will end up profitable, the probability of OTM, the probability that 50% of max profit will be achieved, the probability of touch…

I’m really keen on Tastworks after reading your review and watching many of their videos.

I’m really keen on selling strangles due to their high probability of success using 2SD.

What are your thoughts?

I’m glad that you enjoyed my review. In my opinion, tastyworks and tastytrade, in general, are great. They provide tons of information and tools.

I like your high probability approach. Selling OTM options is a great strategy. However, you shouldn’t just sell random options. You should definitely know what you are doing and get some education on the topic first. For example, it is important to look at the implied volatility (IV) and other metrics when trading options.

Furthermore, when selling very far OTM options (like 2SD), you often only collect a very small premium. Often this isn’t worth the time and capital risked. But this may depend on a trader’s personal preferences. Finding a balance between risk, reward and probability of profit is important.

If concepts like implied volatility are new to you, I really recommend checking out my free options trading education. Even if you think you know a lot about options, it definitely does not hurt to learn more. In my courses, I outline and explain how to sell OTM options with a high probability of profit.

Hi Louis

Thanks for the great reply!

I opened my tastyworks account today so now I wait for it to be approved…exciting!

I’ve been watching loads of the tastytrade videos and this has helped me with learning options all over again.

I fully agree with you that I shouldn’t sell random options which is why I am thinking of selling high probablity/OTM/strangles using indexes (SPX, etc). Hope this is a good starting point.

I have been reading up on IV, IV rank and standard deviation. Since I am still new to this I am not sure whether I will or should be using 1SD or 2SD. I’m hoping after my tastyworks account is approved I can start to have a look at their trading tools myself as my current broker doesn’t have all these cool tools! I don’t really know the difference between premiums collected yet for 1SD or 2SD but yeah, maybe 2SD is a waste of time as it’s TOO safe (hence the low return)?

I’ll check out your course as I am VERY interested in selling OTM options with a high probability of profit.

Good to hear that you are educating yourself! It is very important to do so.

Taking a look at the trading platform and look at different options and all the relevant factors like probabilities, premium, risk… is a great way to learn. 2SD could be considered too safe and a too low return. For example, you only collect a few pennies for a 2SD OTM call option with 47 days left until expiration on QQQ. But QQQ also has relatively low IV. Nevertheless, 2SD usually collects very little premium.

Hopefully, you will enjoy my courses.

I’ve started looking at your course, its superb!

Yeah I was beginning to think that 2SD is too low risk to trade strangles with.

I’m still finding my way around all this and am hoping tastyworks helps me price trades and work things out (the info in their website looks excellent).

What underlying would you recommend to start with for strangle trades and how much capital should I start with if I want to start with one contract strangles?

It makes me happy to hear that you like my content.

There isn’t really one right asset to trade strangles on. But as straddles profit from decreasing IV, I recommend an asset with high implied volatility (IV rank over 50). Furthermore, the asset has to be liquid (high volume, high options volume, tight Bid/Ask spreads). If the asset is a stock, it should not have upcoming earnings.

Generally, it is a good idea to stick to major indexes/ETFs as these offer the most liquidity and diversification. However, currently implied volatility is relatively low which isn’t an ideal environment for option sellers.

As strangles are undefined risk strategies, you will need a margin account and quite some capital to be able to put them on. I don’t recommend risking too much of your capital at once. Ideally, you should not risk more than 5% of your account capital on a single trade. This means that you need to set a max risk level for your strangle and that should ideally be under 5% of your total account capital. A good risk level for strangles is three times the collected credit.

If you don’t have enough capital for that, you could trade short iron condors as these are the defined risk counterpart to strangles.

You could check out my article on how to make money with options to see my step by step guide to selling options.

Wow, I just learned more about trading than I have ever known. Tastyworks sounds good, but I’ve never traded before. I have thought about it quite a bit, but when I do, it seems to be too complicated.

This review is spot on what I need and I am going to re read your article and check them out.

Thx

If you found that trading sounds too complicated, you need education. Without education, becoming a successful trader is very hard (close to impossible). If you want to, you could check out my free trading education in which I break everything down step by step.

where can I find this free trading education?

Hi,

You can check out TradeOptionsWithMe’s free trading education here.

Make sure to let me know if you ever have any other questions or comments.

Hi. Loved reading your review. I had very little experience before started with Forex. I’ve only used it for training and nothing else preety much. I was not so successful with my demo account and I was afraid I might loose revenue if I invest real money.

I have a question. I have noticed you gave a really good grade on your total TastyWorks experience. Now, is TastyWorks good for complete beginners and does it have a demo account as an option?

Thank you in advance.

Strahinja

Hi Strahinja,

Thanks for the comment. Yes, I find tastyworks to be a very good platform for beginners because compared to other broker platforms their platform is very easy to use and there aren’t hundreds of different hidden features that no one knows how to use.

Currently, tastyworks does not offer paper trading/demo accounts. However, they have already announced that they will bring out paper trading in one of the upcoming updates.

Louis,

I have always been afraid to get involved with a brokerage firm due to unavailable information when I am trying to research them or it is to complicated. Your video makes this seem much easier than I thought and I am think of checking into this one and possibly a couple more. Thank you for explaining how this works now I do not feel inadequate in trying something new.

Susan

Happy to help!

I was searching for ways to trade options and found your site. You really have given me good insights on how to start trading options through Tastyworks. Is this platform only available for those residing in US or is is globally used? Since the commission is really affordable, I would like to start with them. Hope you can let me know. Thanks.

Hi Florence,

Tatsyworks is not only available for US-residents. It accepts clients from a very wide range of countries. Here is a list of the currently accepted countries:

Andorra, Argentina, Austria, Belgium, Bolivia, Brazil, Chile, Czech Republic, Denmark, Dominican Republic, Ecuador, Egypt, Estonia, Finland, France, French Polynesia, Germany, Greece, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Malaysia, Malta, Mexico, Namibia, Netherlands, New Zealand, Norway, Peru, Poland, Portugal, Puerto Rico, Romania, Saudi Arabia, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, UK, and Uruguay.

I know so little about the stock market. I believe it is an education in itself. So at some point we need to be willing to trust someone with our money in their hands. I do have to admit as much as I understand it does feel like the costs here are reasonable. I would have to talk to someone in person before handing over money but this seems like a great place to start. Thank you for such in depth info even if I still have a hard time understanding.

Hi Dale,

I think there has been a misunderstanding. Tastyworks is a broker platform that allows you to manage your own money. You aren’t handing your money over to someone who will trade for you. All the trading/investing is done by you and no one else! So you aren’t blindly trusting anyone with your money.

Nevertheless, I have to agree that mastering the stock market requires education and time!

I tried to open an account with Tastyworks after reading your excellent review and was very disappointed to find that it’s not possible to use them from Australia. Do you have a different platform that you could recommend that’s usable from Australia?

Many thanks

Jen

Hi Jen,

I am sorry to hear that tastyworks isn’t available in Australia. But I believe that tastyworks will be available in Australia sometime in the near future. I found this page on which you can subscribe to notifications about when tastyworks will come out in Australia.

Otherwise, I have to admit that I am not a huge expert in brokers available in Australia. But I am pretty sure that thinkorswim which is another good platform isn’t available in Australia either.

One broker that I am relatively certain that is available in Australia is Interactive Brokers. They have a pretty good and fairly advanced platform. However, in my opinion, their platform isn’t necessarily the most user friendly or easiest to use. I think it might take some time to get used to. Furthermore, as far as I know they have a $10 000 account minimum (if you are above a certain age).

I hope this helps.

Your site content is by far the best. In searching and reading about options thru online search and youtube, I am more confused of who is legit or not because too many claim they are the best and with secret source and try to up-sell. I bought @ 3-5 high cost courses and I am not even using their services and my mistake. I found Tastyworks from my other paid subscription and since using it and loving it, but since I do not understand as I like to on analyzing my current/planning trades, I wish I can find someone go over the each screen and do the trade with me. They have super tech support but only limited time. They don’t tell you that but I feel time limited in support. Thanks for your excellent service and prosper~ (oh, all my stocks purchased with gurus’ recommendations are all in red and some down 50%. I did not use trailing stop in time because I did not know enough and I am just hanging on to it)

Hi Karol,

Thanks a lot for the comment and the kind words about TradeOptionsWithMe. I am sorry to hear that you have had many bad experiences with other trading services in the past. I hope TradeOptionsWithMe will be better. If you ever have any questions or anything similar, just let me know and I will see what I can do for you.

When will paper trading mode be available on TW?

Sadly, I can’t give you any exact information on this. However, as far as I am concerned, tastyworks are planning on releasing paper trading in 2019. Hopefully, in early 2019…

Hi Louis,

First, I want to say thank you for building this website and sharing the options trading knowledge for FREE. I’ve learned a lot from your articles. (I would say your articles are much better than the so-called ‘gurus’)

I’ve just opened my Tastyworks and transferred the funds in it. Can’t wait to start my journey in options!

But there is one thing I want to have your kind suggestion. I’ll start at a small amount (around $2000), would you still think the strategy of selling OTM options is a good choice for me?

Wish you all the best!

Hi,

Thanks a lot for your comment. It’s awesome to see that you could learn something from my content!

I do believe that it is still possible to successfully sell options in a small account. You just have to focus on small defined risk trades on lower-priced assets.

Make sure to let me know if you ever have any other questions or comments.

I must commend you for taking your time to share this review of tastyworks, you have introduced me to tastyworks because I haven’t heard of it not until I read this article. The features are really cool and convincing, it’s really great discovering the cheapest trading broker that I know, I will keep following you to get more updates from you.

Very informative site, I must say very educating as well. There is so much rich content in your post, a person almost wants to go back and read it again to make sure you did not miss anything. Got to give kudos for that. You do not find reviews that is that thorough anymore. I had to give credit where credit is do. Great job.

Cheers,

George

Thanks a lot, George!

You mention in your review that you have seen their plans for upcoming features. May I ask what features you have seen that are planned for 2019? I am keenly interested in conditional orders and portfolio margin. Thank you! Amy

Hi Amy,

Thanks for your comment. As far as I am informed, the tastyworks development team plans to release the tastyworks API in 2019. Other planned releases besides the ones mentioned in this article are complex orders, portfolio margin, crypto cash and futures in IRAs. Sadly, there is no specific launch date for any of these features yet. So I don’t know when they will be finished and released. But hopefully, it won’t take them too much longer.

Hi!

Just stumbled here after reading the Feb 2019 Barron’s Broker Review, where they say highly of TastyWorks as a fast new broker rated overall in the 2nd ( 3.5-4 stars) category, but highlighted for options and helpful videos.

1. Are they available for Canada residents?

2. Is paper trading options available as for TDAmeritrade thinkorswim platform I believe?

Cheers,

Thanks for your comment,

Sadly, tastyworks is not available in Canada as of right now. However, they are planning on adding Canada in the near future. You can learn more about the countries in which tastyworks is available and sign up for the Canada waiting list on this page.

Currently, tastyworks does not support paper trading. But this is one of their upcoming features.

I really hope this helps. Make sure to let me know if you have any other questions or comments about tastyworks or anything else.

Hi, what’s the real problem for Slovakia, is it also on the list? can it be an incomplete jurisdiction?

Hi,

Sadly, Slovakia is currently not on the list of supported countries for tastyworks. I can’t tell you the reason why. You could try contacting tastyworks support. They might have an answer.

I contacted and still the same, they must follow the rules

Louis I opened a cash account. I don’t want a margin account because I really don’t understand what I am doing yet and I am afraid I will screw up. I only want to sell covered calls and cover the puts with cash. About all I want to do is go short. I used to have a license but I only sold mutual funds and that was over 30 years ago. It’s like I have to learn everything all over again. Make sure they give you credit. I used your link. I have not funded the account yet. The commissions are so much cheaper than what I am used to. I have had a brokerage account all my life since I was in my late twenties and that was a really long time ago. I am 69 now and retired. Tom

Thanks so much for your comment. It is a very good idea to start with a cash account if you aren’t sure how margin works yet. I really hope my education will help you in you journey to relearning your trading knowledge and skills. If you ever have any questions or comments, don’t hesitate to let me know.

Hi Louis,

As an American Citizen, opening an account with Tastyworks, can I trade while I am abroad, in another country, outside USA?

Thanks a lot,

Stefan

Hi Stefan,

That depends on what you mean by being abroad. If you are referring to relatively short term travels, you can certainly use tastyworks while traveling. However, if you plan on residing outside the US for a longer time period, I recommend asking the tastyworks support team this question including all the specifics. The answer might be different depending on which country you want to live in.

Hi Louis, thank you for the informative write up of Tastyworks. I was wondering if I open up a cash account with $0, will I get access to the watch list and IV rank? I was thinking of using the watch list and IV rank to do paper trading on Think or Swim until I get comfortable and save money to open a margin account with Tasty Works. Thanks!

Hi Johnson,

Yes, that should be possible. Tastyworks does currently not have a minimum deposit requirement. You should even be able to directly open a margin account and fund it later.

Yes. I have been with Tastyworks for a few years and they are by far the best for options. One facet of the Tasty experience that I did not see discussed really is Tastytrade. You want education? Tastytrade has tens of thousands of hours of options education, everything from just getting started to the super advanced strategies, options on futures, futures themselves, and on and on. And, it is all free. You don’t even need an account with Tastyworks. For me. that is where they really shine. When they sold TOS to Ameritrade they had the money to retire and go away. But they founded Tastytrade to educate, Tastyworks for trading, Dough for beginning traders. amd now even the Small Exchange which is an actual listed exchange for trading proprietary small futures products to give people an exposure to futures. They even travel around the country giving free seminars on trading, products, strategies. etc. Who else does that? They have truly disrupted the financial world. For the record, I am not a Tastyworks employee, shill, or anything beyond just being a customer. But I respect the hell out of these people and what they have accomplished.

Hi Tim,

I completely agree with you. Besides having created one of the best and cheapest options trading brokers, Tastytrade offers so much more value for literally nothing! Their education, content, and attitude is amazing. They truly are positive outliers in the trading industry.

Thanks for your comment.

I have been considering either switching to IB or to Tasty from TDA. do you think I should go with tasty instead of IB?

Hi John,

Sorry for the late reply. That depends on what you are looking for. If you want a great and really cheap platform that focuses on options trading, I’d recommend Tastyworks. However, if the vast majority of your trades are stock trades and you rarely trade any options at all, IB might be a slightly better choice. In my opinion, the IB platform is very good as well, but it is quite beginner-unfriendly. You could check out both platforms without depositing any funds to get some idea of which platform you’d prefer.

If I’m new and would like to do paper trading first, would you recommend Thinkorswim instead of Tastyworks?

Overall, I’d recommend Tastyworks. However, if you are purely interested in paper trading, you would currently have to go with Thinkorswim because as of right now, Tastyworks has not yet brought out paper trading. But they have already announced paper trading to be one of their upcoming features.

been with TOS for 10-12 years and since TD will be absorbed by Schawb thinking I may just switch over to Tasty…why not???

Some experience in trading options.

You definitely can’t go wrong with tastyworks.

Do you have a ph# to call and ask questions on setting up a options trades when I start using your tasty works? How do I learn the many different the best use of options trades? I have traded many different calls and puts but much of spreads, coradors, buttery flys, and etc.

Hi Richard,

I do not offer a service hotline. However, I am always happy to help you if you send me a mail or leave a comment. Furthermore, the tastyworks team does offer a live chat option which usually answers your question within minutes.

Otherwise, you could check out some of my free options trading education if you want to learn more about options.

I hope this helps.

Do you have a tutorial on setting up your Tastyworks platform most efficiently and using its abundance of features?

Hi Jason,

Thanks for your comment. As of right now, I don’t really have such a tutorial. But I’ll make sure to add one in the future. For now, I recommend checking out the tutorials on Tastyworks’ website.

Thanks for the suggestion.

Good write-up. I read through your article before I decided to open a tastyworks account. I also have accounts and years of experience with Etrade(was the optionhouse platform) and Interactive brokers.

One thing that needs to be clarified in your article is your use of the term margin. TW does not give a margin account for 2k. Options cannot be purchased on Margin. Options are non-marginable securities. Instead, You are given option buying power which is totally different and each individual trade is calculated differently against your buying power.

If you want a margin account with TW for marginable securities, they require 150k+. Etrade required me to have 100k for my margin account.

I realize TW platform does not appeal to everyone. I actually find the Desktop and Browser platforms easy to use. There is actually a lot of statistical information provided to trade complex options strategies. I had to watch a bunch of their videoes to understand their trading style and how intuitive the software is to that style. The software is in line with Think or Swim (which is the same team that wrote TOS).

If you are a serious option trader the app platform will frustrate you. I used it on my iPad, but found it was just much easier and better to use the web platform on my iPad when I travel. At home or in my office, I use the desktop platform.

I quit trading on IB, because their platform is so outdated and clunky. It was the bomb for it’s day. I still use “Power Etrade” (optionshouse software) for trading options as I am used to it and there are a lot of built-in perks. I don’t think they are keeping it up as they should. The nice thing about TW is that they are constantly updating and adding new things to their software.

One major con with TW is order flow. TW fills are slow and options are not always priced the same compared to IB and Etrade who are tied directly to the exchanges and use multiple routes. TW clears only through Apex. By doing this TW takes to receive compensation for each order they send (flow) to Apex. That does not bother me, but the slowness of the order flow does which means slow fills. Because of this, I use my Etrade and IB accounts for intraday trading.

Other than that, this is a great platform for beginners. The education that they provide, for free, is equal to none and much better than what so-called gurus charge tens of thousands of dollars for.

A few cool things with the software is that other traders on the TW team can push their trades for you to see and to replicate. This is done live time if you watch these traders on the tastytrade network. This is great for beginners since you can sort of have a free built-in mentor.

Another cool thing is the built-in lists that pre-screen for highly liquid trading stocks, liquid ETF’s, etc, This saves me tremendous time for finding trades.

The team is very responsive to questions through email. I’ve only asked one question but got an answer back within 5 minutes.

I am an old dog that has been trading for over 20+ years. For those who are new to trading options and want to learn how to use the platform effectively, the link below takes you to their Where do I start series. The platform can be overwhelming when you first open it. Even though I have 20 years under my belt, this series taught me a few things and gave me a refresher on the greeks and how to effectively roll trades.

https://www.tastytrade.com/tt/shows/wdis-options-101/episodes/brittanys-story-01-03-2017

Hi Joe,

Thanks for your thorough and insightful comment. First of all, I just want to say that it is possible to use margin privileges in a tastyworks margin account as long as it has over $2000 in it. One of my accounts has under $5000 of account capital, but I am still able to short, sell naked options, and use leverage. This wouldn’t be able without margin.

I certainly agree with you that, as of right now, the app still needs some improvement. But like you said, the tastyworks team is steadily working on improving their platforms and adding features. So I am sure it is only going to get better.

I personally haven’t actively traded with IB, but I have tried out their platform before. From this, I have to completely agree with you. Even though they have many features, the platform isn’t very intuitive or beginner-friendly at all.

As for order flow and execution times, I have never had any issues with it.

Lastly, it is certainly true that tastytrade provide some of the best options trading content out there, and all of it is free of charge. That is truly awesome.

Hi Louis : i am rewriting some points that i would like to know your comments:

a) are there any way to open a demo account at Tastyworks.com without fund with 2000$ Actually i dont have this money yet.

b) if the a) questions dosent has a good solution for me then … would be feasible pay a montly afordable fee to open and use a real/demo account’?

Thanks Louis

Hi Adrian,

You can’t really open a demo account, but you can open a real account without depositing $2000. It’s totally possible to use the platform and trade with less than $2000. You just need to have $2000 in your account to use margin privileges. There are no monthly fees that you have to pay at tastyworks.

Hopefully, this helps.

I am Canadian and Tastyworks does’nt open account for Canadian. Do you have any suggestion to open account!

My only alternative is Thinkorswim with Td Bank direct investing. What do you think about Thinkorswim?

Hi Mark,

Thanks for the comment. Thinkorswim definitely is a good alternative to tastyworks. Their platform might be a little less beginner friendly, but they have many similar features as tastyworks.

Hey Louis,

A quick question – with your affiliate link what exactly are we getting upon opening an account with TW? Actually receiving 10 options or 100 shares of a company? E.g. we will receive in the account 100 shares of INTL (or some other stock with share price of about USD 20-25 maybe? I mean I would love that but it seems huge so I think I am not understanding exactly – thus my question.

Tnx in advance!

Hi and thanks for the question,

The current promotion allows you to pick 10 options or 100 shares. The stock will be chosen at random and it is priced between $1 and $6. However, the probability that the stock will be below $2 is 70%. To learn about all the details, make sure to check out the full terms and conditions page here.

Hi Louis

I’m from Australia and I currently use Saxo Markets to trade US equities and options. I’ve found that Saxo Markets don’t allow you to trade all US stock options as it is not feasible. I believe Tastyworks is now available to Aussie residents. Does Tastyworks allow you to trade all US stock options ?

Thanks for help

Cheers

Hi Bill,

I have never experienced that an option isn’t available in tastyworks.

Hello Loius,

A happy year 2021 for you!

Thank for your review.

I´m a begginer for trading.

Does tastyworks pays in Mozambique – Africa?

Do you have any other suggestion like tastywroks?

Thanks in advance!

Hi,

A happy new year to you too! I don’t believe tastyworks currently supports customers from Mozambique but you could ask their support team just to make sure.

I am not sure which brokers support customers from Mozambique, but you could look at a broker such as interactive brokers.

I hope this helps.

Hi Louis,

I am a Canadian with a Questrade account. What should I do while I wait for Tastyworks to open here? Also, I can’t get the advanced quiz to come up.

Thanks, Tim

Hi Tim,

I am sorry, but sadly I am not very familiar with the choices in Canada, so I can’t really recommend anything specific.

hi Louis

very good review of the tastyworks platform but how do you fund your account if you are outside the US. i am based in UK and it’s a pain in the back to fund my account. What’s the easy way to fund my account.

thanks

Ash

Hi Ash,

I did so using a wire transfer.

I live outside US. I opened a US bank account with Wise – their fees are very reasonable. You can connect your bank account with TastyWorks then transfer funds to/from your Wise account for free via ACH.

Hi Louis,

First of all, thanks for all of your excellent content. I just finished the advanced education last night and so I am preparing to start trading. I am confused about some of these terms like “cash account” or “margin account”. If I wanted to sell options using option strategies you’ve described, what kind of account would I need to sell options? If I need a margin account, I guess that means I would also need at least $2000 to start with tastytrade. I’ was hoping to get started with 1000, are there any other options for me or would you recommend I just save the extra thousand and start trading with tastytrade once I reach 2000?

Thanks!

Hi Eric,

Yes for selling options you need a margin account with margin privileges. Otherwise, you would only be able to trade options strategies that do not involve selling any options.

hello

what is the best broker and platform for option on futures and

when will tastywork have a paper trading?

thank you

Hi david, sadly I don’t have any more information on this either.

I am delighted with your review and with Brokerok tastyworks in general!

Thanks a lot!