As planned for a while and requested, I will start a new article series: Live Trade Examples/Trade Case Studies. In this series, I will present and walk you through some of my trades. I will break down every aspect of the different trades: entire entry, exit plans, profit targets, strategy setup, market assumption, P&L, probability of profit, reason for strikes/strategy… I will try to diversify the presentation of different strategies and trades. This means that I won’t only show you winning trades (even though most of my trades are winning, because I use a high probability trading strategy), but I also want to present some losing trades. I will try to explain why I lost and why I won on the different trades and conclude if they were good or bad trades.

Case studies and examples are one of the best ways to learn new things. They give you a good impression of how things can be and are done. The theory that you learned in my education can be seen in practice in these examples. They should give you a very good impression of how I trade, enter, exit and set up positions.

Summed up, this is the place where you can get full insight into my thought process while trading.

Select One Of The Example Trades Below To Learn More About It:

Live Option Trade Case Study: 1 – Near Perfect Credit Spread

- Strategy: Credit Spread

- Market Assumption: Bearish/Neutral

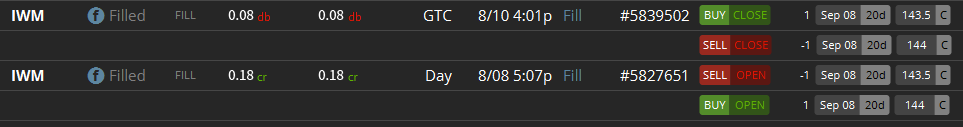

- Underlying: IWM

- IV Rank: 50

- Days To Expiration: 31 Days

- Days Held: 2 Days

- Profit Target: 55%

- Profit Target Reached: Yes

- Probability Of Profit: 65%

- Max Loss: 32$

- Max Win: 18$

- Position Size: Under 5%

- Upcoming Earnings/Dividends: No

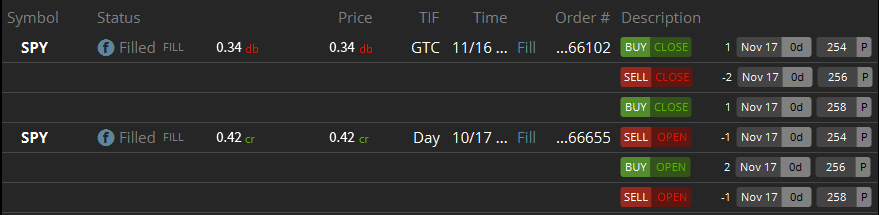

Live Option Trade Case Study: 2 – Credit Spread In SPY

- Strategy: Credit Spread

- Market Assumption: Bearish/Neutral

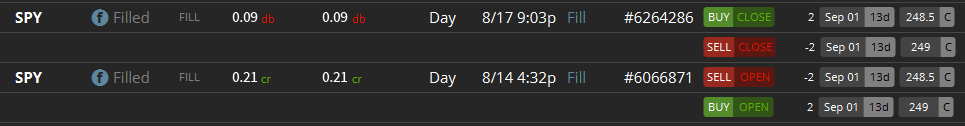

- Underlying: SPY

- IV Rank: 35-40

- Days To Expiration: 18 Days

- Days Held: 3 Days

- Profit Target: 55%

- Profit Target Reached: Yes

- Probability Of Profit: 65%

- Max Loss: 21$

- Max Win: 29$

- Position Size: Under 5%

- Upcoming Earnings/Dividends: No

Live Option Trade Case Study: 3 – Losing Earnings Credit Spread

- Strategy: Credit Spread

- Market Assumption: Bearish/Neutral

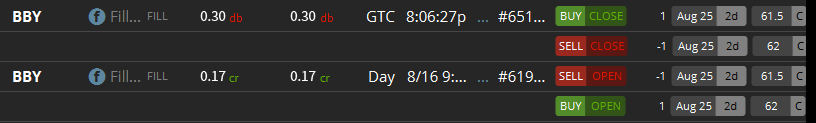

- Underlying: BBY

- IV Rank: 90-100

- Days To Expiration: 9 Days

- Days Held: 7 Days

- Profit Target: 55%

- Profit Target Reached: No

- Probability Of Profit: 67%

- Max Loss: 17$

- Max Win: 33$

- Position Size: Under 5%

- Upcoming Earnings/Dividends: Yes

Live Option Trade Case Study: 4 – Average Winning Credit Spread

- Strategy: Credit Spread

- Market Assumption: Bearish/Neutral

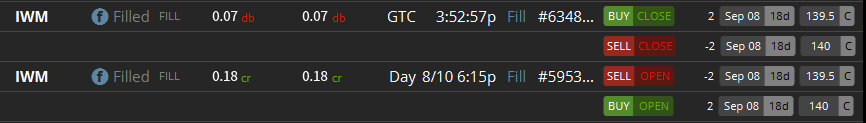

- Underlying: IWM

- IV Rank: 30

- Days To Expiration: 28 Days

- Days Held: 11 Days

- Profit Target: 55%

- Profit Target Reached: Yes

- Probability Of Profit: 65%

- Max Loss: 18$

- Max Win: 32$

- Position Size: Under 5%

- Upcoming Earnings/Dividends: No

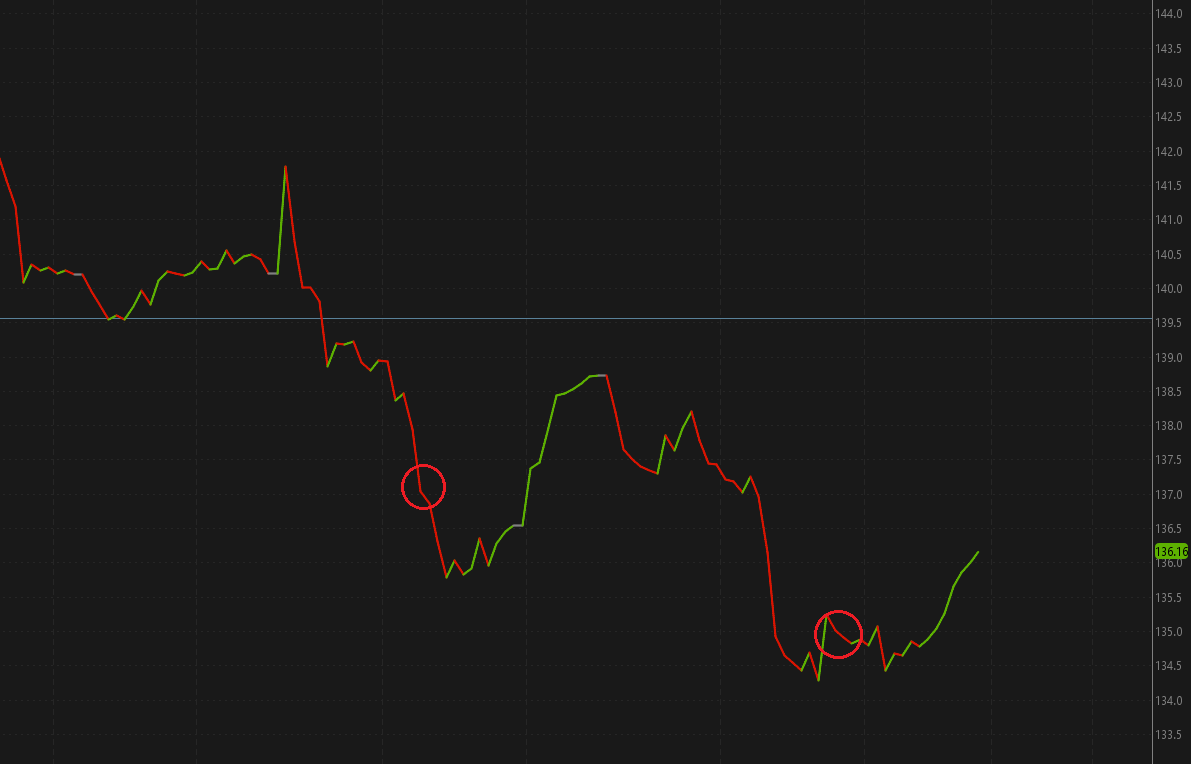

Live Option Trade Case Study: 5 – Short Butterfly In SPY

- Strategy: Short Butterfly Spread

- Market Assumption: Price Indifferent

- Underlying: SPY

- IV Rank: 10

- Days To Expiration: 30 Days

- Days Held: 29 Days

- Profit Target: 60%

- Profit Target Reached: No

- Probability Of Profit: 84%

- Max Loss: 42$

- Max Win: 158$

- Position Size: 10%

- Upcoming Earnings/Dividends: No

More Coming Soon…

I have always been interested in trading. Thank you for writing about it and showing your successes and failures because it is truly interesting to me to see this. I will read more of your successes and failures and learn from them so I can do it in the future.

I have one question: how much success is there in trading?

Hey Brendan thanks so much for the comment.

Trading can improve your life by a long shot. But this of course depends on the trader and his trading style. I just yesterday published a post about the reasons and benefits of trading. In there I discuss what trading theoretically could do to you. If you are interested, you can read it HERE.

Louis,

I have been trading for over a year in options.

I have had many “huge”successes but can not seem to avoid the losses.

I seem to have to much optimism that “It will come back”

The trading sizes has been my real downfall from keeping my good trades.

I need to set automatic exit some how in options to minimize my losses.

If I depend on seeing it to exit I miss the out with profit.

You see almost all have been profitable before major reverse to losses.

I have went from 22k to 7k back to 20k down to 5k back to 7k now at 4k.

Account stands at 10k and would like to nail down the last piece of plan.

THE EXIT.

So catching the reverse or setting an auto exit strategy or alarm is imperative at this point.

I have no problem pulling trigger – but have not surmised away to catch the bullet before it impacts.

Daniel