Eventually, a live (option) trade example/case study that was NOT profitable! Even though this is not good for my account, it is good for you (and me) to learn from. Losses can often be great ways to recognize some problems and improve these for the next time. Luckily for you, you don’t actually have to experience these losses as I am already doing this for you. I am the one that has to improve things next time, but you can do it right the first time. In other words: you should learn from your mistakes/failures, but in this case: you should learn from my mistakes/failures. This trade was another credit spread (more about credit spreads HERE) in BBY which had earnings coming up. Yet again, this trade was performed in a small broker account meaning that this could theoretically have been done in almost any account, no matter what size.

Before I start with the actual trade, I want to say that all the trade examples including this one were performed inside of the broker platform Tastyworks. If you are interested, you could read my Tastyworks Review.

General:

Once again, I will start by presenting the underlying that I chose and the reason for that choice. As mentioned before, I chose Best Buy Co Inc (ticker symbol: BBY) as the underlying. If you don’t know Best Buy, it is a big consumer electronics chain. BBY’s stock is a very liquid security with a lot of relative liquid options, especially recently. Back when I entered this trade BBY had earnings coming up in around 8-9 days. This led to a very high implied volatility (IV) Rank. The IV Rank of BBY back then was well in the nineties, which is extremely high and potentially ideal for options selling. In implied volatility environment like these option sellers normally should sell a little more aggressively than usual, but as I did not want to do any special earnings trade I held myself back a little. Lastly, another reason for my choice of BBY was that I found some options on BBY that had great pricing, but more on that further down.

Strategy:

For this trade, I once again went with a Credit Spread. Credit spreads are just a great and very profitable strategy that can be used in practically any market. With credit spreads, I often choose the strategy before I actually pick an underlying asset because they can be done on almost anything. This also was the case for this trade. But I chose the directional assumption after the underlying security. To do this, I typically take a quick glance at the chart, but mainly I decide this based on the pricing of the options (in small accounts). I will tell you how I determine ‘good’ pricing in a few seconds. If I trade in a larger account, however, I do have to pay attention to my overall portfolio/open positions. In bigger accounts, it is important to diversify yourself and it is a good idea to strive for a neutral portfolio. Therefore, your market assumption in big accounts on a new trade should be influenced by your existing positions. Ideally, it should be something that helps your portfolio become more neutral.

Strategy Setup:

The underlying security, BBY was trading for 60.65$ around when entering into this spread. As I don’t want to make a directional bet on this trade, I chose two OTM Call options:

- Short 61.5 Call

- Long 62 Call

Additionally, these two strikes seemed to have good liquidity and good pricing. As for the expiration date, I went for the August 25th expiration date which had approximately 9 days left until expiry. I know this isn’t a lot of time, but BBY had earnings very few days after this expiration and this was the only contract that expired before the earnings announcement. The small 0.5$ spread between the two call options decreases max loss (and max win), which is good for this small account.

My max achievable loss on this trade was 33$ and my maximum achievable gain was 17$ (per contract). The probability of profit (POP) was ca. 67%. I only ordered one contract of each call option. Normally, I would have ordered a few more, but as I knew that the earnings date was very close and prices often move a lot around earnings I went for a smaller position size. Nevertheless, I almost always keep my position size below 5%. Before this entry I made my usual calculation which is:

POP x Max Profit – (100-POP) x Max Loss

If this calculation is greater than zero, the price is good enough for me. Otherwise, I either adjust the price or don’t make the trade. This was the calculation for this credit spread:

67 x 17 – 33 x 33 = 50

If this calculation is ‘successful’, I consider the price as good. Therefore, I sent out an order at this price and it was filled right before the market close on that day.

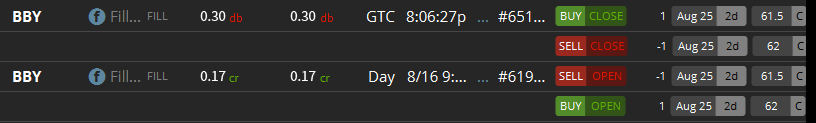

Just after the entry I sent out a GTC order at my profit target which was approximately 55% of the achievable gain. As you can see below, I put an image of the chart with some indications. First of all, the long horizontal line indicates the breakeven point. If the BBY’s price had stayed below 61.5$ until expiration, this credit spread would have reached max profit. As a credit spread is an overall short options strategy, time decay or the option Greek Theta work in favor of this spread. In other words, this spread would have profited a small amount every day just because time passes. The two red circles show the entry and exit point. The second red circle/exit point is above the horizontal breakeven line meaning that I exited this position at a loss and not at a profit.

This has several reasons which I want to sum up now:

I said earlier that I entered this position around 8-9 days before expiration. Already after a short time, my credit spread in BBY was turning profitable and was in the green. This is because the price of the underlying fell a little as clearly visible on the chart. Sadly the price did not fall far enough for the spread to reach my set profit target. It only reached 30-40% of the maximum profit, which was not enough for the GTC order to get filled. After about 4-5 days the underlying price began to rise again and this without any real pullbacks. Very soon the price crossed the breakeven point leading to a paper loss. In other situations, I probably would still have held on to this position and would have hoped for a pullback in the close future. But as these options only had very few days left until expiration, I did not want to do this. Here are some risks of doing that:

- High Assignment Risk. (Don’t know what assignment is? Click HERE.) A short ITM option with only 2 days left until expiration has a rather high chance of being assigned. This is somewhat unpleasant to go through, especially in this small account and it is not worth it considering the small potential win on this trade. Additionally, assignment risk on this short option would probably have been even higher than options with upcoming earnings have an even higher chance of being assigned. This is the case because there are quite a few people that buy options to exercise them to buy the underlying stock for the earnings announcement.

- Theoretically, there would also be Gamma Risk. Gamma risk is the risk that a close to expiry option can change in value very fast compared to other options. Options with high Gammas can change a lot in value for very small moves in the underlying price. Nevertheless, this wasn’t a too big factor for my spread because it was a defined risk trade and a very small position.

This led to an early exit at a loss of this trade. I’d rather exit a position at a small loss than risking getting assigned. Therefore, I closed the credit spread for a debit of 0.30$ (entry was a credit of 0.17$). My overall loss was 13$ which is more than acceptable.

Conclusion:

Even though this trade was closed at a loss, it was profitable for a while and I do think that I could have managed and set up this trade a little better. The main problem factors were:

- The very short time frame

- Earnings coming up

This restricted the position a lot. Afterwards, I think it wasn’t the smartest idea to enter this trade so close to earnings and expiration. This increased risk of assignment and the risk of big moves. Additionally, I think that the loss was a result of relative poor managing. I remember when entering this spread, I told myself to set the profit target rather low because of earnings and the time frame. Nevertheless, I did not adjust my GTC order to that. If I wouldn’t have been so greedy and just taken the small profit when it was there, this spread would have been profitable.

This is easy to say afterwards, but I definitely think that this would have been doable. Nevertheless, I don’t think that this trade was a very bad trade. The entry was still relatively good. The IV Rank was high, pricing was good… The fact that the earnings date was very close just irritated me a little. That was also the reason why I went for a very small position size, which is good. This is a great example to show the importance of small position sizing. Before an entry, you never know if a position will be profitable or not and there will always be losing trades. Therefore, it is so important to keep position sizing low. Otherwise, your overall account often won’t survive.

Last but not least an additional minor reason for my ‘poor’ managing may have been my trading psychology. Before this loss, I had many consecutive good winning trades. Therefore, I probably expected this trade to go as fluently as all the other ones and didn’t handle correctly. This is a very common symptom, especially among new traders. Many winning trades can often give traders a wrong impression and make him/her think that he/she is unstoppable. This sadly often leads to bad trading behavior and habits. That is why a good trading mentality/psychology is very important.

Helpful article I will be sharing this with my oldest son. He has been working on teaching himself how to trade on the stock market. He is a self learner he has leukemia and has not been able to go to college. So he has been doing what he can to learn from home and he’s also been recruiting others to help him. Thank you so much for this and I will make sure he gets it. I will look forward to reading more from you in the future.

That is very inspiring. Thanks so much for sharing this story. I would love to help your son how to learn trading. Feel free to contact me if you or your son has any questions.

Wish him good luck from me, I really hope that he will get well soon.