Before reading this article, you should already have some general knowledge about how options work. If this is not the case, I highly recommend checking out my Beginner Options Trading Course. In this article, I will present a relatively popular option trading style, namely high probability option selling. It is very important to read the entire article carefully even though it is long, so don’t skip ahead. Rather than skipping parts of the article, take a break and come back later to finish it.

Note that this isn’t the only way to make money with options. There are countless other strategies out there. This is just one very popular trading style.

Selling Options Premium

Selling options and collecting premium is the main idea of this trading style. The goal is to sell options that eventually will expire worthlessly or at least lose some of their value. In essence, a high probability option seller works quite similar to an insurance company. Think of the option as an insurance contract. Let’s take a house insurance as an example. People buy house insurances to protect themselves against the unlikely event that their house will burn down. The insurance makes money because the big majority of all insurances aren’t ‘necessary’. Most of the sold insurance contracts will never be used as most houses won’t burn down.

High probability option sellers try to do the same. They sell (OTM) options and expect them to expire worthlessly. The buyer of that option hopes for the unlikely event that the underlying asset’s price moves more than usual so that his option does not expire worthlessly.

But once in a while, someone’s house does burn down. Then the insurance company has to pay out their insurance money. But as the insurance company collected money from many other ‘unnecessary’ insurances, they can easily cover this loss.

The same goes for the option sellers. Not all sold options will expire worthlessly. Once in a while, an option won’t expire worthlessly but hopefully, the profits from the past few trades will cover this loss.

In the following article, I will present how you can trade options like an insurance company sells insurances.

An Introduction To Probabilities

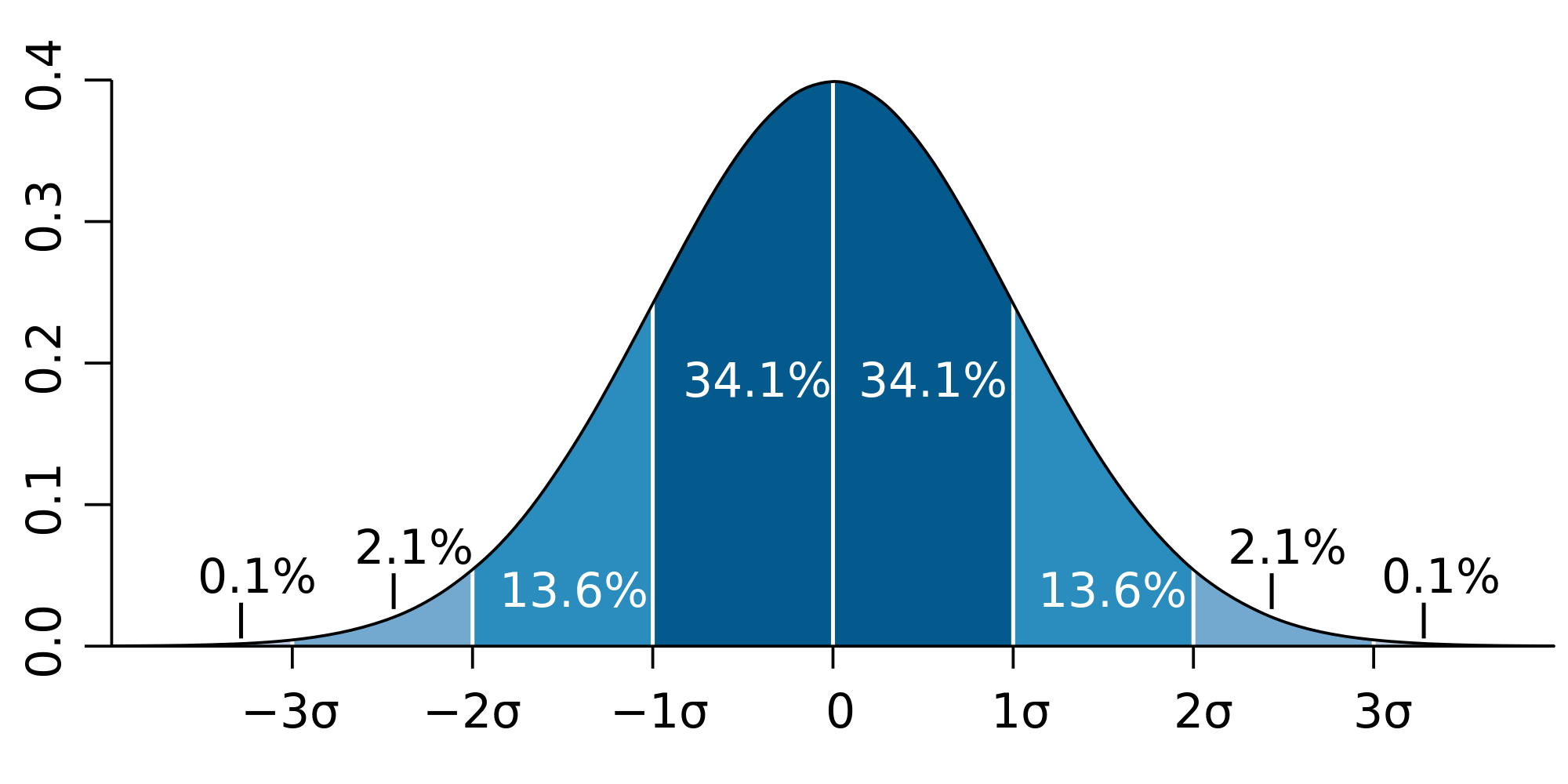

You may (or may not) recognize the following diagram from probability theory. The diagram is a normal distribution/ standard deviation diagram. Normal distribution diagrams are used on all kinds of stuff. This is the case because most things have a certain normal distribution.

For example, most people have a similar body height. Obviously, there are exceptions to both the up and downside. But generally speaking, the height of the vast majority of people is in the same range. Therefore, a normal distribution diagram can be used for heights.

For example, most people have a similar body height. Obviously, there are exceptions to both the up and downside. But generally speaking, the height of the vast majority of people is in the same range. Therefore, a normal distribution diagram can be used for heights.

Around 68% of all people have a body height in a certain range. The chances of having a body height either under or above this range become smaller the further you get away from the range. Someone who is 2.10 meters (ca. 6,9 feet) could be considered an outlier because only very few people are this tall.

The same can be applied to stocks and other trading assets. Stocks move in ranges. More often than not, stocks move maximal a few percents per day (or even less). A $100 stock mostly doesn’t move more than a few $1 up and down every day. Rarely does a $100 stock move $50 up in one day. Thus, stock price movement can be put into a standard deviation diagram. I will try to simplify this with a brief example:

Let’s say stock XYZ is trading at $200. By looking at XYZ’s price history, you can calculate that XYZ’s price hasn’t risen or dropped more than $10 inside of a 40 day period about 68% of the time. It hasn’t moved risen/dropped more than $20 in a 40 day period ca. 95% of the time and it hasn’t moved more than $30 in such a period 100% of the time…

You may be asking yourself why am I telling you this…

Standard deviation diagrams and probabilities play a huge role in (options) trading. Certain mathematical models like the Black Scholes Model allow us to calculate the probability of profit (POP) for different option positions. This is very powerful! Let’s take the XYZ example again:

XYZ is still trading at $200. An options trader knows that XYZ’s price has not increased/decreased more than $10 (in a 40 day period) about 68% of the time. This knowledge can (and should) greatly impact his choice of option(s) to trade. He knows that the probability that XYZ’s price stays between $190 and $210 is approximately 68%. Therefore, he could consider selling the put option at the 190 strike price and the call option at the 210 call option. This strategy would have a probability of profit of at least 68%.

If the option trader would be extra conservative, he could consider selling even further OTM options to increase his POP more.

An asset will usually close within a one standard deviation move up or down 68.2% of the time, within a two standard deviation move 95.4% of the time and within a three standard deviation move 99.7% of the time.

The chart below is a chart from the very popular ETF SPY tracking the S&P 500 index. I marked the one and two standard deviation moves (30 days) to the up and downside. But note that this chart snippet is during a quite volatile time.

Factors To Consider:

The first very important factor that affects the probability of profit and the standard deviation is time left until expiration. The more time there is left, the higher the probability, that the underlying asset’s price will move further, becomes. This should make sense to you. If you give a stock’s price 10 days to move, it will most likely move less than if you would give it 100 days.

The first very important factor that affects the probability of profit and the standard deviation is time left until expiration. The more time there is left, the higher the probability, that the underlying asset’s price will move further, becomes. This should make sense to you. If you give a stock’s price 10 days to move, it will most likely move less than if you would give it 100 days.

A 10% move inside of one or a few days is much less likely than a 10% move in a year.

Therefore, the normal distribution diagram of an asset with lots of time will be wider than a normal distribution diagram with little time.

Let’s go back to the XYZ example yet another time:

We said that a $10+ move up or down inside of 40 days has a probability of profit of about 68%. If we change the time frame, this probability will change as well. The probability of profit for a $10+ move up/down will be much smaller if the time frame changes to 10 days. In other words, a $10+ move up or down in XYZ will be much less likely occur within 20 days than it would in 40 days.

If we increase the time frame, the probability would increase as well. A $10+ increase or decrease in XYZ’s price will be more likely if we give the stock 200 days than it would be if we only would give it 40 days.

The next major factor to consider is Implied Volatility (IV). Implied volatility basically is the expected volatility. If an asset is expected to move a lot, it has high implied volatility. In times of high implied volatility, the normal distributions diagram is widened out as well. A bigger move inside of a relatively short period of time will become more likely in times of high IV.

The opposite is true for times of low implied volatility. When implied volatility is low, so when the asset is not expected to move a lot, the normal distribution diagram will be tightened.

Once again, I will try to show this with our XYZ example. XYZ is still trading at $200 and the one standard deviation move would still be $10 up or down. If implied volatility would decrease, this one standard deviation range would also decrease. Now there is a 68% probability that XYZ won’t move more than $8 up or down instead of $10.

If implied volatility would increase, a bigger move would become more likely. The one standard deviation move could now be $12 to each side instead of $10 or $8.

As you can see, knowing if implied volatility is high or low, is very important for (options) trading. To find out if IV currently is high or low, you could/should use IV Rank. IV Rank compares the current implied volatility of an asset to the history of the IV on the same asset. It then puts out a number between 0 and 100. An IV Rank over 50 would mean that implied volatility currently is high and an IV Rank under 50 would mean the opposite.

How And Where To Find The Probabilities:

As you may have realized by now, probabilities play a big role in the world of (options) trading. Knowing the probabilities is essential for your success with options. But many of these probabilities are based on complicated mathematical models or huge data sets.

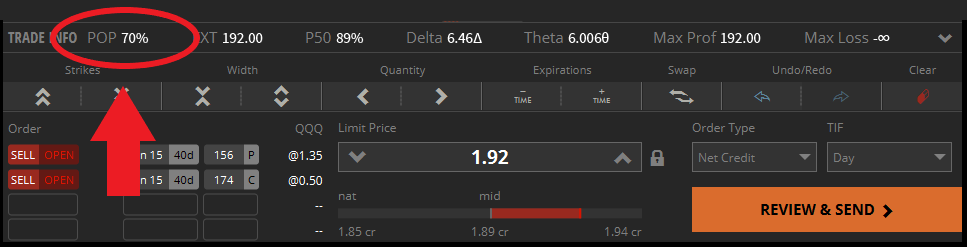

Luckily for us, we don’t have to calculate the probabilities ourselves. Every good broker platform will do this for you! Some brokers show you the probabilities directly on their option chain. Others have separate analyze tabs or other features.

Most broker platforms mainly display the probability of ITM for each option. This is the probability that an option will expire In The Money (ITM). To find the probability that an option will expire OTM (Out of The Money), you have to subtract the probability of ITM from 100.

An alternative to the probability of ITM is the option Greek Delta. Delta can be used as a rough estimate for the probability of ITM meaning that a Delta of 0.4 would be a probability of ITM of ca. 40%. But note that Delta often overstates the probability of ITM. Generally, it is best to use the actual probability instead of alternatives like Delta.

Good broker platforms also show the probability of profit for option strategies (combinations of different options).

To Learn More About Tastyworks, Check Out My TastyWorks Review!

This Is Not Your Typical Strategy!

Note that this trading style is quite different from how most traders and investors make/imagine making money. As we discussed earlier in this article, stocks and other assets usually don’t move too much at once. Obviously, there are exceptions, but most of the time most stocks won’t increase or decrease in value by a substantial amount in a short period of time.

In other words, most of the time stocks (and other assets) do not move more than one standard deviation up or down. But sadly, most people don’t get this. Most people try to predict these unlikely big moves either up or down. This is a relatively low probability strategy because most assets don’t move more than one standard deviation most of the time.

We as high probability option sellers try to do the exact opposite. So we take the other side of the trade. Our goal is to sell an option and hope that the underlying asset won’t have an unusually big move. High probability option sellers, therefore, often profit from range-bound/neutral/sideways markets. But even if the underlying asset does move up or down, we won’t lose money immediately. As long as the underlying assets don’t move more than normally, we should be fine.

Why Does it Work – Is it a Zero-Sum Game?

High probability option sellers will usually have a lot of ‘small’ profits and a few ‘bigger’ losers. Therefore, option selling might seem like a zero-sum game. If you win $300 70% of the time and lose $700 30% of the time, you won’t make any money in the long term because all your gains will be wiped out by the occasional big losers (300 * 70 – 700 * 30 = 0). Luckily, this is not the case for high probability option selling. This is not the case due to multiple reasons:

- Implied Volatility (IV): Historically speaking implied volatility has been overstated most of the time which means that prices have moved less than expected most of the time. As you learned in a previous lesson, options are more expensive in times of high IV. If options are more expensive in times of high IV and IV has been overstated most of the time, there is an edge. The edge is that options have been too expensive most of the time. This means option buyers have been paying too much for their options and option sellers have been receiving too much most of the time!

In other words, the probability of profit when selling options often is even higher than displayed (in times of high IV). So if the displayed POP is 70%, the actual POP may be slightly higher. - Managing Winners: This may sound weird, but taking profits early will increase your probability of profit. This is because a profitable position can always turn around. If you take it off the table, it won’t be able to turn around anymore because you closed it. Therefore, it is a good idea to take profits at levels like 50% of max profit (for defined risk strategies).

- Other Criteria: Not all options will be good potential positions. Filtering out bad potential positions can further increase your probability of profit. But more on certain criteria later down the road.

Step by Step Guide to Success

Now you should know the basic premise of this trading style. In the following part of this lesson, I will present a step by step guide to this trading style.

Step 1 – Finding The Correct Setups

First of all, you will have to find an underlying asset to trade options on. Here you shouldn’t just pick a random asset. You should look for certain criteria and only trade options on underlying assets that meet all the criteria. Here are some of the most important aspects to look at when choosing assets to trade options on:

1. Liquidity

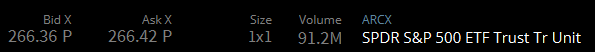

Liquidity is probably the most important aspect to look at when trading (options). Liquidity measures how easy or hard you can enter and exit positions in an asset. Highly liquid assets usually have a huge volume, very tight Bid/Ask spreads and are thus very easy to enter and exit. If you choose to trade an illiquid asset, you will potentially have trouble entering and exiting position(s) and there will be bad pricing. Therefore, it is very important to focus on very liquid assets with lots of volume.

An example of a highly liquid asset is the ETF SPY. SPY tracks the very popular S&P 500 index. As you can see on the screenshot below, SPY has a very tight Bid/Ask spread (this is after-hours, normally the Bid/Ask spread is much tighter) and a lot of volume (91.2 Million shares in a day). In fact, SPY often has even much more volume (multiple hundred Million shares on some days).

You shouldn’t only look at the liquidity of the underlying asset itself. You should also look at the liquidity of the options on the underlying asset. This can be done by looking at the volume, open interest and Bid/Ask prices of some options.

Generally, you should stick to some well-known and heavily traded indices, ETFs, stocks… Most of these well-known assets should be liquid and have liquid options. If an asset isn’t liquid enough, just avoid it.

2. Implied Volatility (IV)

The next major factor to look at when choosing an underlying asset to trade is implied volatility. Implied volatility can have a huge impact on options pricing. Therefore, it is important to know if IV is high or low. As I always say, you can use IV Rank to find out if IV currently is high or low. When selling options, it is important to pick assets with high implied volatility. This will lead to more expensive options which means that you, as an option seller, collect more premium. So when selling options, try to find liquid assets with an IV Rank of over 50.

3. The Price

Depending on your account size, you won’t necessarily be able to trade options on all assets. If you find an asset with very expensive options and your account size is small, you probably should look for a different asset. But note that you can also adjust your risk with different strategies. But more on that further down. Some assets only have limited options and these can often be expensive. So try to find an asset with options that fit your account size.

4. Upcoming Events/News

In addition to the previous aspects, you should also look at upcoming news or events for the asset. This can give context to the previous aspects. For example, if a stock has upcoming earnings, implied volatility will likely be high because many stocks move a lot after an earnings announcement. Try to avoid assets with big upcoming events like earnings… These assets will likely move more than other assets and therefore, decrease your probability of profit. Also, try to avoid assets with an upcoming ex-dividend date because this can greatly impact your risk of assignment and the option’s price. If you aren’t familiar with the different dates related to dividends, make sure to check out my article on how dividend stocks work.

Step 2 – Forming A Directional Assumption

The second step is to form a directional assumption on the underlying asset. Do you think it will go up, down or go sideways? This step will influence your strategy choice which is one of the next steps. To form a directional assumption, you could use something like technical analysis or fundamentals… But frankly, it really doesn’t matter too much because we are trading with a high probability of profit. This means that the underlying asset’s price could move against you and you wouldn’t start losing money straight away. As long as the underlying asset doesn’t move in a huge manner, you should be able to profit.

Some (high probability option) traders believe that choosing a direction is a 50/50 shot anyway. Therefore, many traders prefer trading neutral strategies over ‘directional’ strategies. Later down the road, your directional assumption could also be influenced by your current portfolio. But more on this in a later lesson.

Try not to overthink this step. You shouldn’t perform tons of technical (or fundamental) analysis here. Just decide whether you want to be bearish, bullish or neutral on the underlying asset.

Step 3 – Selecting A Strategy

Now it is finally time to select a trading strategy. This choice should be influenced by some of the previous factors like the directional assumption, price, availability of options…

As you hopefully know, options are much more versatile than stocks. In stock trading, you would either buy or sell a stock depending on your directional assumption. But in options trading, you can literally choose from and combine hundreds of different options.

But for this trading style, we will focus on a few option strategies only. All of these strategies will be overall short strategies as we are want to sell options and not buy them. Depending on your risk profile, you can choose between defined and undefined risk strategies.

I won’t go over the specifics of each strategy because this article is about high probability option selling as an overall trading style. To read about specifics, I recommend checking out the strategy section after finishing this article!

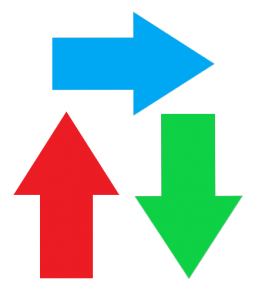

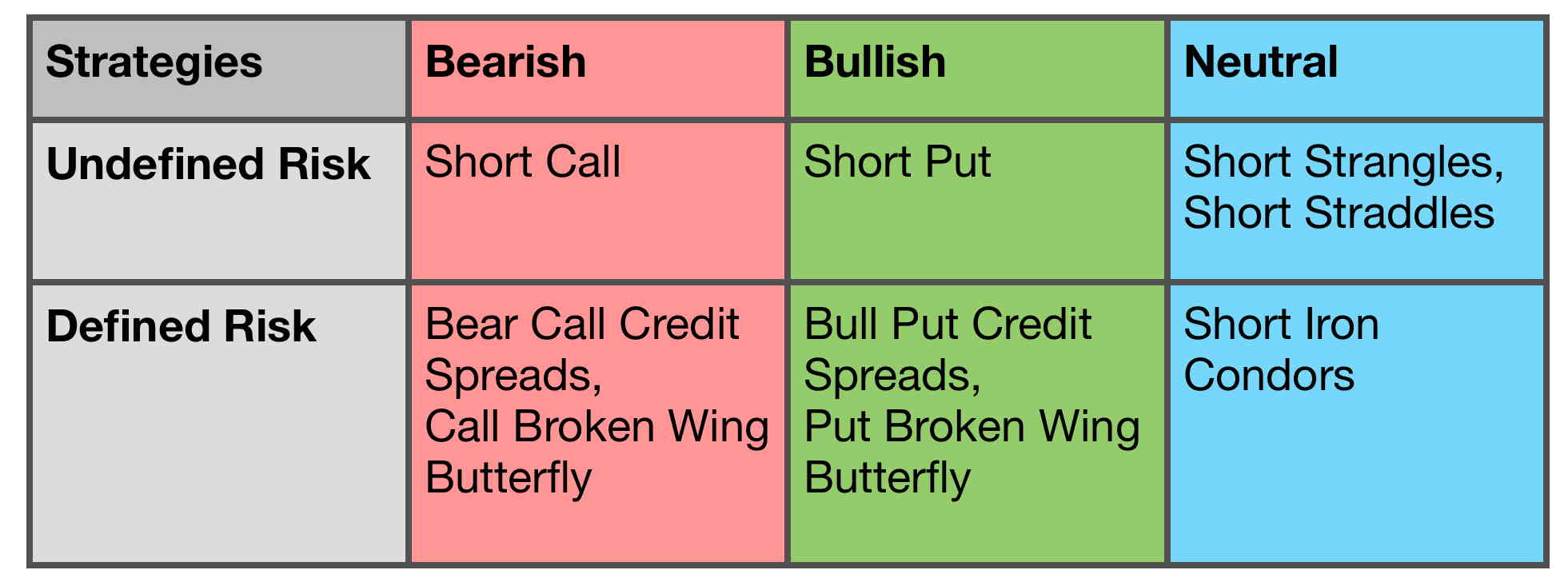

The table below shows some option trading strategies suitable for high probability options selling:

The directional assumption is marked by the colors (red for bearish, green for bullish and blue for neutral). Strategies in the upper row are undefined risk strategies and strategies mentioned in the lower row are defined risk strategies.

If you are interested in downloading the table for later use, Click HERE.

High probability option selling only works with certain option trading strategies. Some key elements that strategies suitable for this trading style are:

- Overall Short: As we are focusing on selling options, we want to focus on trading overall short strategies.

- Collecting Premium: To open an overall short option strategy, you should collect a credit because you are selling something.

- Time Decay: Time should work in your favor as a high probability option seller. In other words, the option Greek Theta should be positive when opening a new position. This will allow you to profit from time passing.

- Implied Volatility: The option Greek Vega should be negative so that you can profit from a decrease in implied volatility. This is very important.

- High Probability: Generally, you should have a high probability of profit when selling options. Focus on high probability setups. Don’t try to be very directional and bet on big moves in any direction.

These were some of the most important aspects of a high probability short option strategy. There is not one best strategy when selling options. There are multiple different strategies that fulfill the criteria above. That’s also why I won’t present one specific strategy. You should try out different strategies for different market scenarios.

Step 4 – Finding The Right Option(s)

After choosing a strategy, it’s time to choose an expiration date, strike prices etc. This once again depends on personal factors like risk tolerance, account size, time… But as a rule of thumb, around 45 days to expiration is a very good time frame. Research from TastyTrade, a financial network, has shown that 45 days to expiration allows you to profit from increasing time decay in the best way. But obviously, you won’t always be able to open a position with exactly 45 days to expiration.

I recommend sticking to monthly expirations and avoiding weekly options. The main reason for this is liquidity. Weekly options often have much less volume and open interest than monthly options!

Which specific strike price(s) to choose depends on the strategy and your preferences.

It is important to stay small when trading options. Like I said before, you won’t win 100% of the time even with a high probability option trading strategy. You will always have losing trades and it is important to keep the losing trades small. The only real way to do this is to trade small on every trade! Never risk too much of your account capital on one trade. I suggest limiting your risk to max 1-10% of your account per position (ideally, 1-5%).

Step 5 – Choosing The Right Price

Step 5 – Choosing The Right Price

Before sending out the order, there is one last thing to consider and that is the price. You should always collect enough credit to make the trade worth it. If you have a small account, you also have to consider commissions. If you only collect $20 of premium and have to pay $7 in commissions, the trade is probably not worth it. I recommend taking in at least $50.

You should also look at your risk/reward ratio. This may not necessarily be the best because of the high probability of profit. Often your risk will be greater than your max reward. But that’s okay as long as your probability isn’t too low. For example, you shouldn’t risk $1000 to make $100 with a 40% probability of profit. However, risking $250 to make $100 with a 75% is totally fine.

Furthermore, you should always use limit orders. This will lead to better pricing and more premium (so a higher max profit). If you use a market order, your order may be filled faster but at worse pricing. If you use limit orders, you can decide what price you want. In very liquid assets, you can often get filled at the mid-price. Doing this will allow you to take in a few Bucks on every trade. This can be a lot of money if you add it up to hundreds or thousands of trades.

Step 6 – Making Money With Options

Now you have put on the trade. This step mainly consists of waiting for the sold option(s) to lose (some of) their value so that you can buy them back for less than you sold them for. I recommend taking profits at 50% of max profit. As I explained earlier, this will increase your probability of profit and it will decrease the time per trade. Taking profits early will, therefore, allow you to put on new trades faster.

To automate this process, you could send out a Good Til Cancel (GTC) order at 50% of your max profit right after opening your positions. Here is a brief example of how this could look:

You get filled on a position and collect $1.5 of credit ($150 because a standard option contract controls 100 shares of stock). You could then proceed by sending out a GTC debit order at $0.75. As soon as the position decreases to around $0.75, the GTC order should be filled and you will thus automatically exit the position.

If a position does not work out as you planned, there are a few possible management options. The management options once again depend on the strategy that you chose. Undefined risk strategies should be managed more than defined risk strategies because your risk isn’t capped. One way to manage the risk of undefined risk strategies is to cut losses at a certain point. Another method is to roll out the strategy to a later expiration cycle for a credit. This can be done over and over again. But more on rolling in another lesson.

Managing defined risk strategies isn’t as important because you have a limited downside. As long as you kept your position size low enough, this max loss should be acceptable. Nevertheless, there are a few methods to adjust defined risk strategies. You will learn them in a later lesson.

It is important to not take off losing positions too fast. This may sound counterintuitive, but it really isn’t. A losing position can always turn around into a winning position. If you take it off at a loss, it will be a guaranteed loss. So if a loss isn’t too big and there is enough time left until the expiration date, you should try to hold on to losing positions. This is another reason why small position sizes are important. If you have to cut losses as soon as a position goes against you, you will miss out on many potential winners.

Many winning option positions are in the red sometime before the expiration date.

Nevertheless, you shouldn’t hold on to obvious losing positions. If there is only a little time left or if a position goes too far against you, just admit the loss and take it. Especially losing positions with very little time left should be rolled out or taken off. This is due to assignment risk. Assignment risk is the risk of being assigned stock (so the risk that you have to deliver/accept shares from someone who exercised your option). Assignments mainly happen in the last week before expiration and only to short ITM option holders. But even a far ITM option with 2 days to go, isn’t guaranteed to be assigned. You will learn more about assignment and how to avoid it in a few lessons.

Step 7 – Starting All Over Again

This step is possibly one of the most important steps! It is essential to repeat the same process over and over and over and over again to make money with options. I will try to explain the importance of repeating this process with an example:

The example is a simple coin flip game. The rules of the game are that you flip a coin and if the coin shows heads, you receive $1 and if the coin shows tails you will lose $1. The odds are 50/50. If you flip the coin once, you will either be $1 up or $1 down. If you flip the coin 5 times, you could have won five times, lost 5 times and everything in between. Something similar would be the case if you flipped the coin 10 times.

But if you flip the coin 1000 times, you will most likely be at or very close to breakeven.

This is because of the law of large numbers! The greater the number of occurrences of an experiment is, the closer the outcome will be to the expected outcome. Let’s apply this to our coin flip example. The expected outcome is that you lose half of the time and win the other half because the odds are 50/50. If the number of occurrences is very small (for example 2) the actual outcome may vary a lot from the expected outcome.

If we flip the coin twice and it lands on heads both times, the actual outcome is 2 heads to 0 tails even though the expected outcome was 1 heads and 1 tails. If we increase the number of occurrences, this deviation will decrease substantially. If we would flip the coin 20 000 times instead of 2 times, the expected outcome would be 10 000 heads and 10 000 tails. The actual outcome will very likely be somewhere around this. It may vary by a little, but it will definitely not be an as big deviation as before. The chance that the coin will land on heads 20 000 and 0 times on tails (like in the example with 2 flips) is practically zero.

The same concept can be applied to our trading. If we put on one, two or another small number of trades with a 70% probability of profit, the actual outcome may vary from the expected outcome. Even if two trades have a 70% probability of profit, they may very well both end up being losers. But if we put on 200 trades with a 70% probability of profit, it is very unlikely that all of them will end up losing. The more trades we put on, the closer we will get to our expected outcome. It is very important to understand this.

Therefore, it is important to increase the numbers of occurrences as much as possible. The higher, the better. This does not mean that you should put on tons of trades at once. It just means that you should have a long-term approach to this strategy. In the long run, the numbers will work themselves out. You just have to stick to it long enough.

CONGRATS, you made it! I know this article was long. But the concepts discussed in this article are extremely important to make money with options. Therefore, I really hope that you understood EVERYTHING in this article. If there is ANYTHING that you didn’t quite understand, PLEASE let me know in the comment section below!!!

This Article is part of the Intermediate Option Trading Course. If you are reading the article as a part of the course, you can continue to the next lesson: HERE

I’ve heard of writing options as a way of making money and I know its something that most people don’t know anything about because they are usually a derivative of a security (stocks).

What are your thoughts on covered calls? (buying the stock at a certain price and writing an option at a higher strike price than what you bought it for, for visitors of this site that may not know).

Do you see any risk in them?

Love to hear your thoughts,

Jessie

Hey Jessie,

Yea I think covered calls are a great strategy escpecially for options beginners. It delivers a good transition from stocks to options trading. This is a great way to give you a small edge when trading stocks. I will probably write and article on this topic in the future

You have simplified the explanation of how options operate. I like that you included the math that explains the probability of your assumption. It would be nice to get your thoughts on what it would take to move from simply buying puts and calls to more complex strategies. I think it is hard for a beginner to understand what it would take.

Hey Todd,

I actually wouldn’t recommend, to begin with buying puts and calls. I believe it is best to start with a lot of education and then immediately start to trade a little more complex strategies that actually are work. You can learn everything from the basics to a consistent options selling strategy in my education section here.

Great post man. I’ve dipped in and out of options a few times before, after being sold on how simple it is to earn thousands everyday!

It’s nice to read an article on actual trading strategies that could help a beginner to create a second income rather than just burn money!

Hey Josh,

Don’t listen to anyone who wants to tell you that you easily can get rich over night with options. It definitely is possible to generate a good and consistent income with options, but this takes time and dedication. Anyone who tries to tell you otherwise is probably just a scammer.

Be careful and good luck.

Louis

I have a question about the 2nd graph down the page. You say, “The diagram above shows and calculates that until Jun 17th this stock with a 68.2% probability will stay between ca. 136 and 152.” Is this from tasty works? Is it correct to assume the light blue area in the middle is the 68.2% area? Im using ThinkOrSwim. They have a similar graph but without the colors.

Thanks

The graph is from an older version of OptionsHouse. But they got acquired somewhat recently.

In this example, it is correct to assume that. But it doesn’t really play a big role as the graph only should show how a standard deviation diagram can be applied to a stock chart.

Many brokers including thinkorswim display the probability of profit (POP)/probability of ITM of each option on the option chain. I recommend looking there to find the probabilities of options (if it is that, you are looking for).

Hey Louis,

This was amazing thank you so much, I’ve been looking into trading options for a while, but still had a lot of questions and other articles just showed very basic information difficult to understand, you were very straight forward and clear, just wanted to thank you for the information and the tools to successfully trade.

My pleasure Victor. It’s great to hear that you liked this lesson.

I have traded options and find your article really concise and useful in that it distills complex concepts into easy to understand, and well organized, information. If you have some statistics on how well your strategies play out, I’m sure that readers like me would enjoy seeing them, e.g. like a trading diary. Keep up the good work! Kel

Thanks for the feedback. Statistics are a great idea. As I currently don’t have a lot of concrete statistics to show, you could check out Tastytrade’s show Market Measures. In it, they present and analyze a lot of backtests mainly for high probability option selling.

Hopefully, this helps.

Hi Louis,

Thank you for a great article. The link to “Tastytrade’s show Market Measures” above is bad.

Thanks again,

J

Hello

Joel, says thank-you for helping me to understand that I do not need to make a lot of trades and over extend myself. I see now I need to let the market come to me. That is if I want to go bearish I need to wait until the indicators meet my expectations. This includes knowing the fundamentals of the strength of a company. Such as, being aware of a company’s dividends and and the due date of their earnings report.

Wishing you the best,

Joel

I am glad that I could help!

What a great article!

Thank you!

Hi Louis,

As a fan and follower of Tasty Trade, I congratulate you on a great article. I’ve been selling premium for about two years using their research and strategies to earn about 6K -12K per month. My problems are found when the market makes a sustained run in either direction, requiring a roll for the tested side of my usual neutral and balanced strategies of iron condor or iron butterflies. I find that rolling gets scary about the third month, as my trades on the tested side are deep in the money. I’ve adopted the Tasty Trade strategy of selling at 50% profit, but also their research suggestion of rolling or selling at 21 days using the 45 day trade window to avoid assignment and volatility.

Assuming that you can finally reach the end of a roll with no credit, do you have any gradual risk reduction strategies that avoid taking even small positions off all at once; e.g., gradually swapping out a 70% Delta call to a corresponding priced put? This keeps your dollar amounts roughly equal and now on the other side of the bet, but the loss would be the same if sold.

Also, do you try to balance deltas using a beta weighted average like SPY?

Thanks!

Thanks for your comment.

First, of all, yes I do use beta weighting und yes I normally beta weight to SPY. As to your second question, my positions usually aren’t big enough for a gradual risk reduction. Therefore, I tend to either close the positions in multiple steps (balanced) or just take it off all at once.

Louis I am just an old guy but I learned something a long time ago and I apply it to my trading. It is this: You make your money when you buy it not when you sell it. By that I mean I look at what a stock is doing that day. And I look for stock prices that are near even dollars or midway i.e. for example $1 or $1.50 in other words that are ITM or ATM because you can sell those options for more money. Then if I find a stock that is falling that meets the criteria then I buy a 1000 shares and then wait for it to rise because the costs of options will then also rise usually after lunch and then I sell 10 contracts ITM. I buy it for less than the strike price if I can but if not I deduct the difference from my premium and I only sell calls with just a few days left (3-4) and my stock is soon gone and I am liquid again. I lived through “Black Monday” and I don’t wish to own stock more that a few hours. I know it goes against all traditional reasoning but it works for me.

Thanks so much for your comment and thank you for sharing your approach to trading. You touched on a very important point: you need a strategy that makes sense for you. Trading is a very individual thing. Everyone has their own preferences, strengths and weaknesses. If your tactic works for you then that’s great. A strategy might be perfect for certain individuals but terrible for others, depending on their personality.

Hello Louis,

Is the Prob ITM/OTM we see in our platform based on the price history of the stock, or calculated using an option pricing model (such as black scholes, etc.)? I think my confusion comes from the fact that the ‘standard deviation’ or POP we find in our broker platform is based on the black scholes or other mathematical option pricing formula with many variables, and NOT the historical price history of the stock, yet they are providing a probability of whether the stock will be ITM or OTM.

Thank you,

Hi Tim,

The probability of ITM is not calculated based on historical stock prices. It is most commonly calculated through the help of the Black Scholes formula which accounts for the underlying volatility, time till expiration, underlying price, strike price and a risk free rate.

You state that you want to wait for your sold option to lose value so you can buy them back for less than you sold them for. I understand that but cant you just let them expire worthless rather than buy them back?

Hi Jason,

Thanks for your comment. Sure, you could do that. However, from a risk-reward standpoint, it is often not worth it to wait for the last few percent of the potential profit while risking the unrealized profit and potential loss. Furthermore, the closer you get to expiration, the faster option prices can change. Therefore, it is often best to lock-in profits after a certain profit percentage is achieved.

It is my understanding that most of the premium decay takes place as we approach expiration, which is in your favor. So as long as the stock price stays within the projected range (1stddev), why give up any portion of the premium you have earned?

Hi Louis,

Very useful article. I am going to read it few times to get it completely. It will be very helpful when I start my option trading in real.

I really appreciate for all the articles you are sending.

Thanks

Harry

Thank you so much for your time. I learnt a lot. God bless you!

Haven’t received glossary yet. Thanks in advance!

Thanks for the comment. You should have received a confirmation mail that you need to accept to get the rest.

Have you checked your spam mail?

Thanks for all of this info Louis. As I’ve started paper trading, it seems that one under emphasized aspect of this guide is the importance of using limit orders and more importantly adjusting the limit price in your favor (depending on your broker perhaps). I notice that Tastyworks will set up your limit orders at the mid-price by default. However, as I practice paper trading with a different broker, I notice that the default limit price is at the high ask price for buy orders and the low bid price for sell orders which I’m always changing to somewhere around the mid-price for both to reduce my cost and increase credit received. Perhaps this is a setting I can change that I just haven’t discovered yet… As you say, this makes a huge difference in profitability over time if you’re using a strategy similar to the one you describe here. Thanks again.