I have a question for you. Please try to answer it as honestly as you can:

How Well Do You Understand Options Pricing And Options Strategies?

To help you answer this question, I have prepared three statements. Make sure to read them and then consider to what extent you agree with them:

- I know more than 8 different options strategies and their basic payoff behavior. (Agree/Disagree)

- I know what the Greeks are and how to use all of them in my trading. (Agree/Disagree)

- I completely understand the relationship between implied volatility, time and price of a wide variety of multi-leg options strategies. (Agree/Disagree)

If you fully agree with all of the just-mentioned statements, you clearly have a very good understanding of options pricing and options strategies.

But don’t worry if you didn’t fully agree with all of these statements. I have created a tool that will help you develop a much better understanding of options pricing, options strategies and much more. I call it The Strategy Lab.

Everything in the Strategy Lab is based on the Black Scholes Model – a mathematical model that won a Nobel Prize in Economics. The model was developed by Fischer Black, Robert Merton, and Myron Scholes and is still one of the most commonly used derivative pricing models.

What Is The Strategy Lab

The best way to learn options is not by reading articles on them. The best way is to try out as much as possible without risking your hard-earned money. That’s exactly what The Strategy Lab allows you to do.

The Strategy Lab allows you to visually learn all the intricacies of the rather complicated Black Scholes options pricing model. Furthermore, it allows you to directly see how changes in market conditions can and will impact your trades. Summed up, The Strategy Lab is the research tool for option strategists.

In my opinion, the best way to present The Strategy Lab is with a short video presentation:

Here is a list of features of The Strategy Lab:

- Interactive Payoff Diagram Creator

- Interactive Charts of All The Greeks For Every Strategy

- Over 2 Dozen Preset Strategies

- Fully Customizable Strategy Creator (Supports Up To 6 Legs of Options and/or Stocks)

- 3-Dimensional Interactive Graph That Visualizes The Relationship Between, Implied Volatility, Time and Price For Every Strategy

- Fully Customisable

- Works On All Devices

- Very Easy To Use

- Ability To Save All Charts

- Lifetime Access + Access To All Future Updates

- Excellent Customer Support

- Access To The Strategy Lab From Anywhere, Anytime

- In-Depth Guide To The Strategy Lab

- And More…

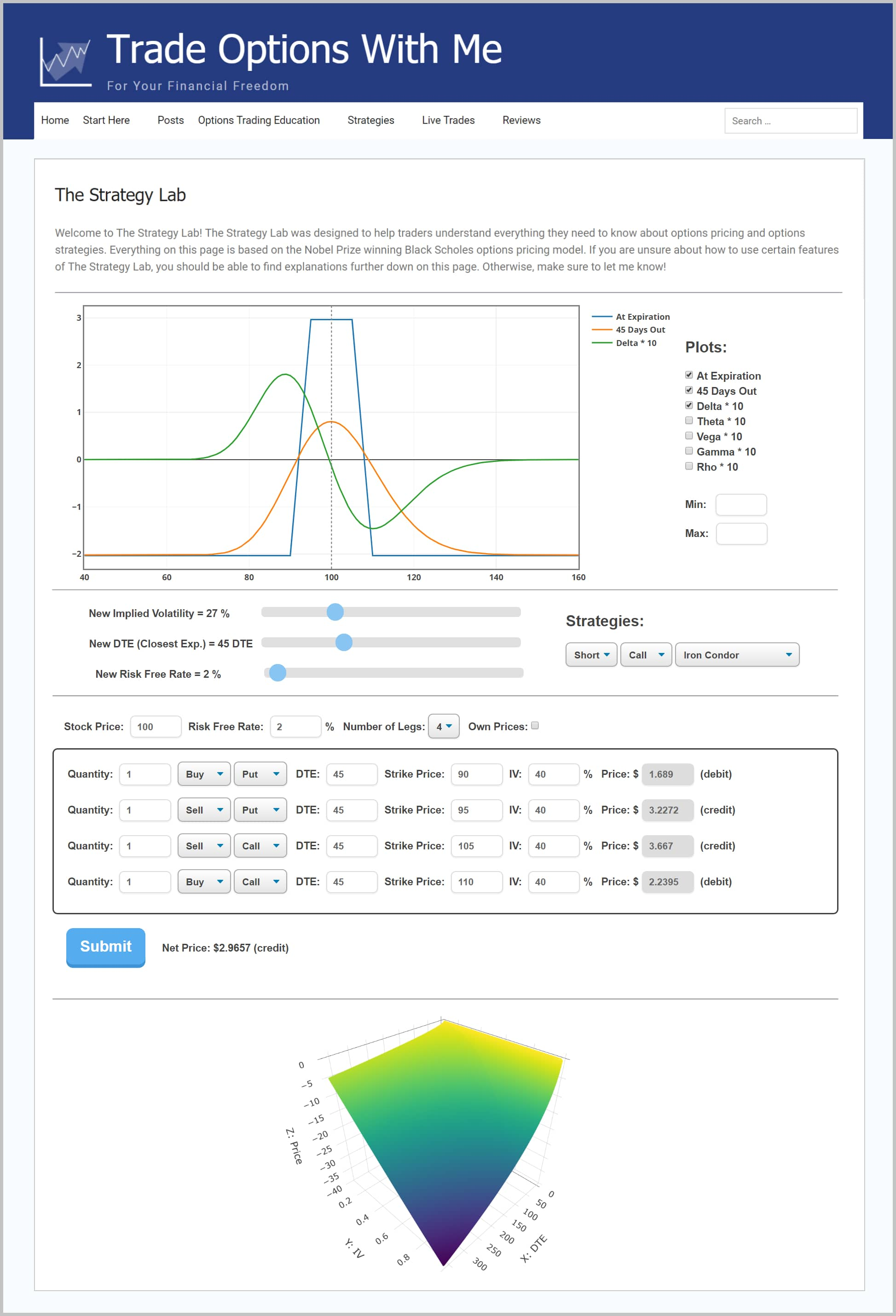

The following image will give you an overview of how The Strategy Lab looks like:

How much does The Strategy Lab cost?

The final price of The Strategy Lab will be a one-time payment of $50. However, if you are reading this, you still have the chance to gain lifetime access to The Strategy Lab (including future updates) for a one-time payment of $29.

That’s over 40% less than the final price!

How To Use The Strategy Lab

Let me present you an example of how The Strategy Lab could be used to analyze the commonly used option strategy: short iron condor.

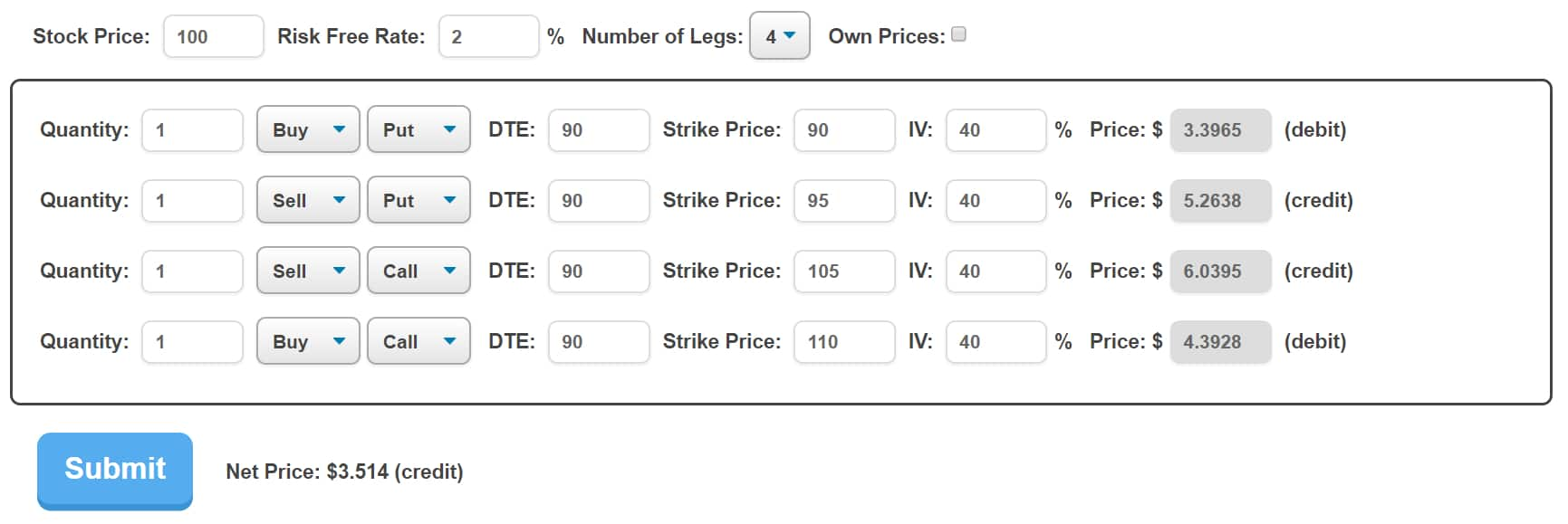

The exact iron condor that I used was set up in the following way (default short iron condor):

The following animation shows how changes in time affect a neutral short iron condor. With the help of The Strategy Lab, this can be done by sliding a slider to the left. You can see the days until expiration of this iron condor on the right-hand side of the animation. (The dotted line represents the underlying’s price at entry.)

For the sake of this example I chose to display four plots:

- At Expiration (blue): This shows the payoff of this iron condor at its expiration date.

- X Days Out (orange): This plot shows the payoff of this iron condor X days before expiration.

- Delta * 10 (green): This plot shows the Delta of this short iron condor multiplied by 10.

- Theta * 10 (red): This plot shows the Theta of this iron condor multiplied by 10.

Theoretically, it would also be possible to display the plots of all the other Greeks at once. However, then it would be hard to recognize what is going on.

The blue ‘At Expiration’ plot looks just like you would imagine the payoff diagram of a short iron condor. It achieves max profit if the price of the underlying stays between the two short strikes (95 and 105). The max profit of this iron condor is $351.4.

Max loss, on the other hand, will occur when the underlying’s price is either below the 90 long

When changing the time until expiration, the blue ‘At Expiration’ plot is not affected because there always are 0 days left for this plot.

Next up, let’s discuss the orange ‘X Days Out’ plot. As seen with this plot, time clearly has an impact on the payoff behavior of the iron condor! The impact that the passing of time has depends on where the underlying asset’s price is. If the underlying asset’s price is in between or near the two short strikes, the impact of passing time is positive. Otherwise, the opposite is the case.

This means, as long as there still is sufficient time left until expiration, an iron condor can still be profitable even if the underlying’s price moves slightly above the upper or below the lower short strike price.

Now let me present, what the Delta plot shows you. Delta is the option Greek that measures the effect that a $1 increase in the underlying’s price has on the option’s price.

With less and less time until expiration, the Delta of this iron condor right around the long strikes becomes more and more extreme. This means with less and less time, this iron condor becomes more sensitive to changes in the underlying’s price. So a small move in the price of the underlying can have a much larger impact on this iron condor when it has little time left than if it would have many days until expiration.

That is one of the multiple reasons why it is a good idea to take profits early on iron condor trades. The longer you wait, the more volatile the profit and loss of the iron condor becomes.

Last but not least, let us talk about the Theta of this iron condor. Theta is the option Greek that measures changes in an option’s price for changes in time. In other words, Theta is the amount that an option’s price will change for the passing of one day.

As you can see on the animation, the Theta of this iron condor seems to be pretty flat while there still is a lot of time left until expiration. However, as time passes, Theta seems to awaken. This means that for every day that goes by, this iron condor will change more in price than it did the day before. The increasing sensitivity to changes in time is not linear. The closer the iron condor gets to its expiration date, the more its payoff will be impacted by changes in time.

Furthermore, it is evident that the Theta is positive while the stock price is in between the two short strikes. This indicates that time will have a positive effect on this iron condor’s payoff while the stock price is between the two short strikes and negative if is elsewhere. The closer the iron condor gets to its expiration date, the narrower the range in which time has a positive effect becomes.

Now we covered all the plots shown on the animation above. Hopefully, my relatively basic analysis of this iron condor could give you some insights into how to potentially use The Strategy Lab. Obviously, this only just scratched the surface of The Strategy Lab’s analysis capabilities.

I only analyzed the effect of time on four plots on one chart of one variation of one option strategy. In addition to this, you could also analyze all the other Greeks, the effect of changes in implied volatility, the effect of changes in the

Conclusion

The Strategy Lab allows every trader, regardless of skill level, to significantly improve their understanding of options strategies, options pricing and the dynamics of options in the markets. These are things you need to know to become a successful (options) trader!

I hope that you can see how The Strategy Lab can further develop your understanding of options and thereby improve your profitability as a trader. You can gain lifetime access to The Strategy Lab with less than the profits of a single good trade: $50 $29

Remember: Right now you can still save over 40%

If you have any questions, comments, feature requests or anything, make sure to let me know in the comment section below. I will do my best to help you out as soon as possible.

Trading is not something that I am familiar with and. The reason I have not yet traded myself is because I have felt quite intimidated by all the things that go into it and the fact that there is a risk involved. My husband has traded on and off over the years and I am sure that this is a tool he would love to try out. He has made some nice side income from trading. This tool is just $29 once off and it looks like it has so much to offer. I’m going to tell my husband about it – thanks for the information.

Thanks a lot for your comment. I hope your husband will enjoy The Strategy Lab and learn a lot from it.

Louis, I have just gotten into trading field within the past 2 months, so I still consider myself very Green. To my surprise, I actually am familiar with the Black Scholes Model, as my best friend (who is a trader full time) tried to teach me about it, so I find the fact that the Strategy Lab is based off of it quite interesting!

I would like to run this program by my friend and see what she says. However, I’m only a beginner and even I can see the usefulness of a research tool for option strategists. I really do aspire to improve my understanding of options strategies and thereby increase my profitability as a trader in the making. I feel as there’s a lot of potential here, so thank you for those post!

Koda

Hi Koda,

Thanks a lot for your comment. I am glad to hear that you see the potential of The Strategy Lab. I hope it will be of great use to you.

Hi louis,

Thank You very much for sharing such an informative article with all the necessary information about “The Strategy Lab”

I am trying to learn trading as it is a great way to earn money.So,in this regard i was looking for a proper guideline. After reading this article i have found the perfect guideline for me in this purpose.I believe this is a great tool for me to start learning about options trading.The price of this tool is $29 once off and it looks like it has so much to offer which has impressed me the most. I will share this great article with my friends and relatives so that they can benefited from this.

I am happy to hear that you enjoyed this article.

Hey Louis,

I’ve really enjoyed reading this article as you’ve provided us with lots of valuable information on this trading analysis platform called The Strategy Lab. I’m very interested in starting with this. $50 seems like a very fair price to me.

Thanks a lot for taking your time in writing this blog. Well Done!

I’ve actually been looking for some help finding a proper option trading strategy analysis platform, and this looks like it might be something that can be of some serious help! Thank-you for writing this very in debt article full of imagery and great content that was very helpful! I hope the best for your website in the future!

Thank you.

Thanks for this article. I really enjoyed reading it. The Strategy Lab seems like a very great tool for me to learn more about options strategies and pricing. In my opinion, $50 is a very good deal for it because that is the size of a normal trade profit for me. I am looking forward to using this new tool.

Hi Louis, your website is a treasure of great ideas, I for the most part I have avoided the stock market and it show these days. It seems I am going to have to send more time learning all of this.

I’m impressed with your thoroughness and the4 scope of your learnings.

Sometimes it feels overwhelming to learn all of this, so I’m wondering if you have any posts for very beginners – baby steps?

Hi Ed,

Thanks for taking the time to comment. I have many articles for beginners. I recommend starting with my free options trading beginner course.

Hi,

After reading your article, I have learned about the Strategy Lab. I did not know much about it before. I have some ideas about trading but since it is risky I’m still studying this issue. I think that people can reduce the risk of trading a bit by using this strategy lab. Since the price is very cost effective and one-time payment is required, I want to join it. Thank you very much for sharing this important article with us

Thanks for sharing your thoughts about The Strategy Lab.

I have been paper trading far OTM Credit Spreads with excelent results and am ready to go on with real time trading. However, finding good candidates has not been easy and I would like to find a good Service that could help me. Any idea?

Hi Ricardo,

I personally use tastyworks for all my trading. In my opinion, they are one of the best brokers for (options) traders. If you want to learn more about tastyworks, I recommend checking out my review of tastyworks.

is this a program we download on our computer or run from your website?

The Strategy Lab is only available on TradeOptionsWithMe. Right now, you can’t download it.

Hi Louis: i am surprised about this tool. Its excelent!!! I will continue with the course and will buy you this tool next. Thanks a lot

Awesome! Thanks for the feedback.

Is the strategy lab compatible with all exchanges ?

Thanks for the question. The Strategy Lab is not actually connected to any exchange. It simply is a graphing and analysis tool for theoretical options prices and strategies based on the Black Scholes Model. You can’t access any live option price quotes from real exchanges through it.

Is it downloadable ?

Not as of right now.

Is it similar to the option net explorer tool?

I have no experience with the option net explorer tool, but from first glance, this tool seems more advanced than The Strategy Lab. The Strategy Lab allows you to set up and analyze the payoff profile of theoretical options positions based on the Black Scholes Model. It does not use any real trading data. I hope this helps. Let me know if you have any other questions or comments.

Hi Louis

is Paypal the only form of payment you accept for your excel spreedsheet and the strategy lab?

do you accept credit cards as well? Each time I try to buy it the screen defaults to Paypal.

Thanks

Hi Gary,

Currently, I can only accept payments through PayPal. But if you have a PayPal account, you should also be able to just pay directly through your creidt card.

(If this absolutely doesn’t work for you, it is also possible to pay with an amazon.de giftcard. But I obviously understand if that doesn’t work for you. For this option, just send me a mail: Louis@TradeOptionsWithMe.com)

Louis, what a great site you have!!!

Could you compare your “Strategy Lab” to Tastyworks “Analysis Mode.” Specifically if a person were to have the Tastyworks platform would they need the Strategy Lab?

Thanks for the comment Zoe. For once, I’d say The Strategy Lab is a little cleaner and simpler to use than the analysis tab. Besides that, the analysis tab doesn’t have as many preset strategies or a graph comparing the relationship between different pricing factors.

That said, if you already are familiar with the analysis tab and like using it, it’s probably not necessary to get The Strategy Lab.

I hope this helps.

Thank you Louis for the prompt reply!

I’m just a beginner at this. The Strategy Lab looks like a terrific tool to have. I’ll give myself a month with option information to see if options are something for me to stick with, then will most definitely purchase it. What a great price! Thanks again.

Hi Zoe,

That sounds like a great plan!

Is the Strategy Lab also provide to buyers in Excel format ? What language is strategy lab programmed in?

Thanks for the comment. The Strategy Lab is written in Javascript.

Hello Louis, I find all your tutorials and website content very insightful, and you deserve all the sucess you already have and with more. I’m currently actively trading in cryptocurrency (about 6 months) and never thought about getting into options trading, but you have made me very curious! I have a question for you, regarding The Strategy Lab. Do you have something similar that I could use for the cryptocurrency or other similar markets? Or do you have any suggestions on how I could go about using it, for the meantime, while I use your resources to gain more knowledge in Futures/Options? Your advice would be so really appreciated. Many thanks in advance. (“,)

Hi Tari,

Thanks for the comment. Sadly, I currently do not know of a similar resource for crypto. But since the payoff behavior of crypto is similar to stocks and much simpler than options, you probably could just use the stock feature of The Strategy Lab.

Hi! is strategy lab a downloadable piece of software or web based? Thanks!

Hi Josh, it’s web based.