Delta hedging is an options strategy designed to eliminate directional risk. This is a great way to focus on and profit from other market factors such as implied volatility or time decay. Learning about Delta hedging and when to apply it can be a great asset for traders of any kind. With that being said, Delta hedging also has its shortcomings which you definitely should be aware of. In this post, you will learn everything you need to know about Delta hedging.

What is Delta?

Before we can get into Delta hedging, it is important to understand what Delta and the Greeks are. The Greeks are different metrics that measure the risks of an option position. Delta, for instance, measures the directional exposure of a position. More specifically, Delta measures the change of an option’s price for a $1 increase in the underlying’s price. To clarify this, let’s look at a few examples:

- A 1 share long position in XYZ has a Delta of 1 since it will gain $1 for every $1 increase in XYZ’s price. Conversely, it will lose $1 for every $1 drop in XYZ’s price.

- A position with a Delta of -0.5 on ABC will make half a Dollar for every $1 drop in ABC’s price. Furthermore, this position would lose half a Dollar for every $1 increase in ABC’s price.

The bigger the Delta of a position is, the more bullish and thus more exposed to down-moves it is. On the flip side, a big negative Delta would translate into a very bearish position. Positions with a Delta of around 0 are considered neutral with no significant directional risk.

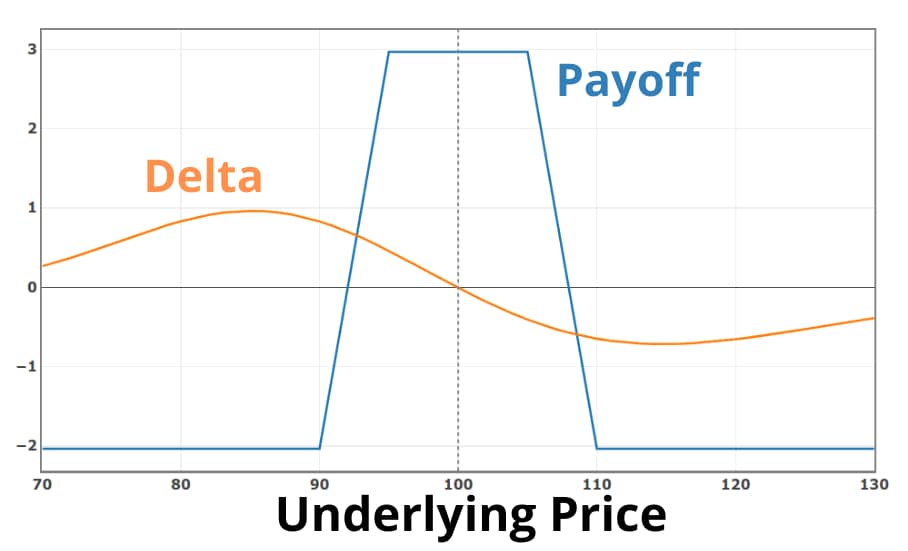

Note that typically Delta (and the other Greeks) are not static. Delta will normally change together with changes in the underlying price. Just because a position has a Delta of 0 at entry, doesn’t mean that there is absolutely no directional risk. As an example, take a look at the following payoff profile:

The blue line represents the payoff profile of an iron condor options strategy and the orange line represents its Delta. As you can see, at entry such an iron condor has a Delta of 0, but as soon as the underlying price increases, Delta decreases, and the position becomes more bearish. The opposite is the case for a price decline in the underlying.

To calculate the Delta of a multi-leg position, you can simply add up all the individual Delta values of each leg. But note that this can only be done if all legs are on the same underlying asset. To calculate the net Delta of multiple positions across different underlyings, you can use beta weighting.

The rate of change of Delta is measured by a different Greek, namely Gamma. Besides Delta and Gamma, other Greeks include Theta and Vega. Theta measures time decay and Vega measures the exposure of a position towards changes in implied volatility.

What is Delta Hedging?

Delta hedging is a risk management technique that seeks to reduce or fully eliminate directional risk. In slightly more technical terms, Delta hedging tries to neutralize your Delta.

Even though Delta hedging might seem complicated at first, it really isn’t. All you have to do to Delta hedge a position is to modify or open a new trade with an offsetting Delta. If your initial position has a positive Delta, you look for another position with a negative Delta and vice versa. If you want to eliminate directional risk as much as possible, the Delta of the second position should be as close to the exact inverse of the first position’s Delta.

The easiest way to Delta hedge is by buying or selling shares of the underlying asset since these will always have a constant Delta of 1 and -1 per share, respectively.

Let’s now take a look at some examples to clarify what Delta hedging is.

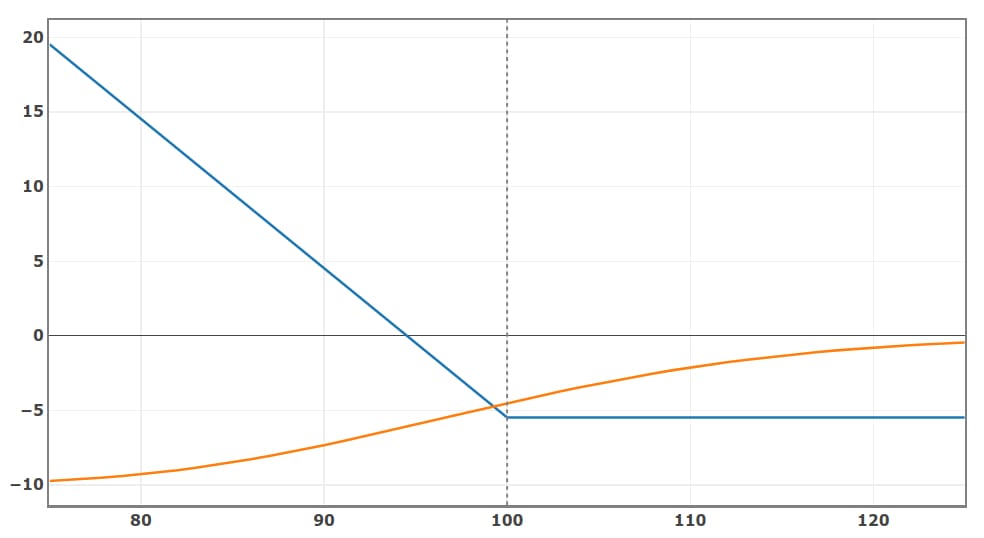

For the first example, let’s say you currently have a long put position on XYZ which is trading right around $100. The following chart displays the payoff profile of that put at expiration (blue) and its current Delta (orange). (Note that the displayed Delta is multiplied by 10 so that it is better visible)

As you can see, this put position currently has a Delta of about -0.45. But since the standard contract size of an option is 100, the true Delta is -45. This means that this position is bearish and loses about $45 for every $1 increase in XYZ’s price. One way to reduce this directional risk is by Delta hedging. To Delta hedge this put position, you would have to find a second position that has a positive Delta of about 45.

One possible trade that has an exact Delta of 45 would be buying 45 shares of XYZ. Doing so will result in a net position with the following payoff diagram (blue) and Delta (orange):

As clearly visible from this chart, the new Delta (at $100) is 0 which means that this position now is Delta neutral. Note that this does not mean that this position has no risk. It is still affected by big price moves as well as changes in other market factors such as implied volatility or time decay.

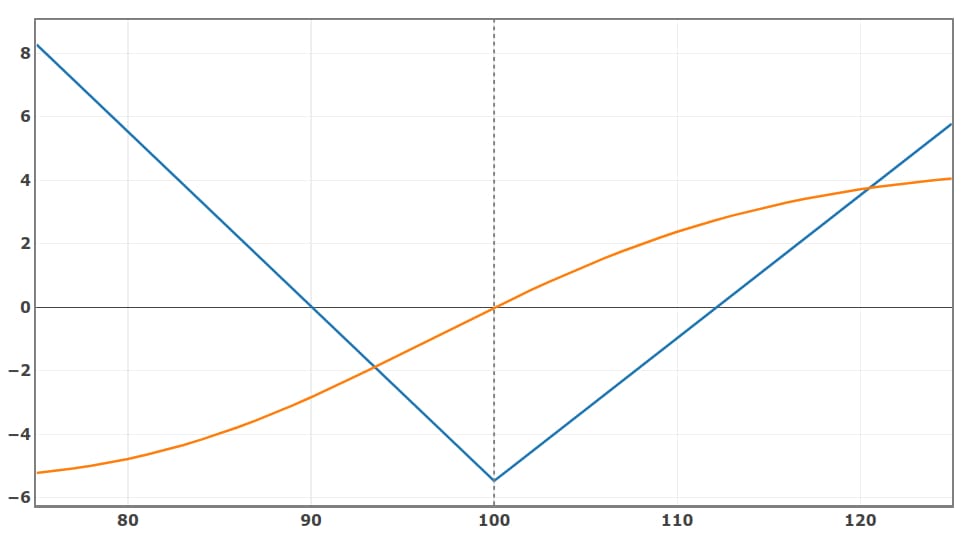

Next up, we’re going to look at one more example that brings up an important problem with Delta hedging.

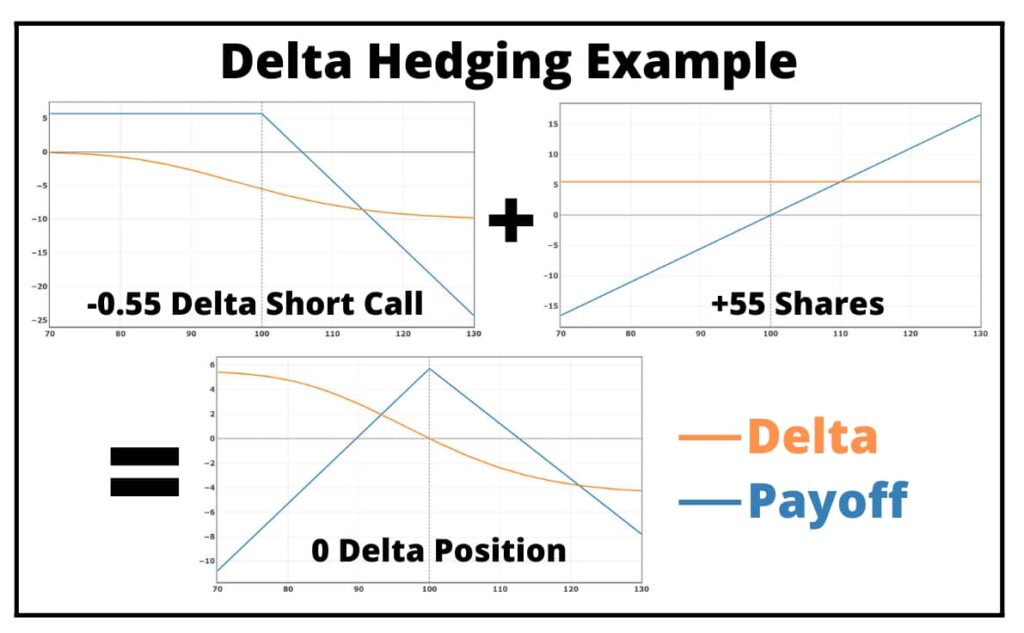

For this example, let’s say you have a simple short call position. This short call has a Delta of -0.55 which means that it profits $0.55 for a $1 decline in the underlying stock. But since the standard contract size of an option is 100, the ‘real’ Delta is -55. To Delta hedge this short call position, you would open a second position that offsets this Delta. In other words, you should open a position that has a positive Delta of about 55. The most obvious trade that would result in a Delta of 55 is buying 55 shares of the underlying stock. Doing this creates a new Delta neutral position.

The following graphic shows the payoff diagrams as well as the Delta of these positions:

As you can see, the resulting bottom position has a Delta of 0. But it is also clearly visible that this Delta is only 0 if the underlying price stays right where it is. As soon as the underlying price moves up, The Delta becomes more and more negative. The opposite is the case for a decline in the underlying’s price.

To solve this problem, we have to re-adjust our Delta hedge on a regular basis so that it keeps offsetting the new directional risk caused by price changes. If the underlying price increases, we need to buy more shares of the underlying, and if it decreases we need to sell some of the shares. Doing this will allow our position to always stay Delta neutral and thereby eliminate directional risk, or at least that’s the theory. In reality, the story is slightly more complicated.

The Problems with Delta Hedging

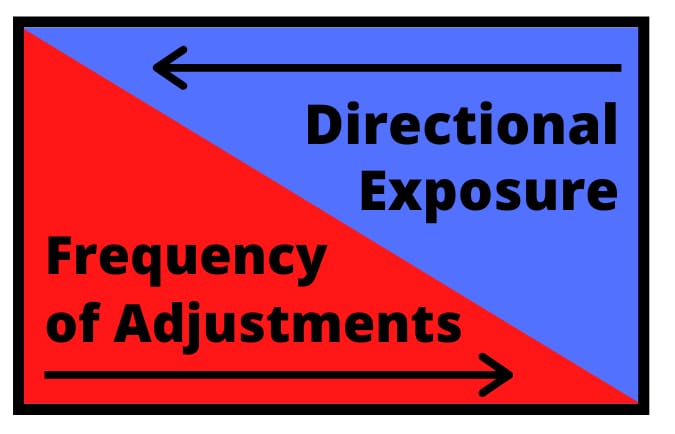

The first and most obvious problem of Delta hedging is the question of how often you should re-adjust your Delta hedge. The more regularly you re-adjust your Delta hedge, the less exposed you are to interim price moves. But on the flip side, the higher the frequency of your adjustments, the higher the associated effort and accompanying transaction costs become.

The following diagram visualizes this tradeoff. Ideally, you want a low frequency of adjustments as well as the least possible directional exposure. Sadly, these things are polar opposites.

There isn’t one right answer to how often you should re-adjust your Delta hedge. This is a tradeoff that every trade has to make for themselves and their personal preferences. If possible, it is a good idea to automate your Delta hedge adjustments since it otherwise can take up a lot of your time.

Another risk that Delta hedging does not eliminate is the overnight directional risk. You typically won’t be able to re-adjust your Delta hedge during the night. Nevertheless, the underlying security can gap up or down until the next market open. No matter how often you readjust your Delta hedge, you won’t be able to completely reduce the overnight gap risk.

Why Delta Hedge?

By now, you hopefully understand what Delta hedging is, but you might not understand why one would want to Delta hedge in the first place. If you want to reduce directional exposure, why not just close parts of your current position?

If you are only trading stocks, this is probably the best way to reduce your directional exposure. But if you are trading derivatives such as options, you might want to focus on other market factors such as implied volatility or time decay. When your main goal is to trade around these factors, directional exposure can significantly impair your efforts.

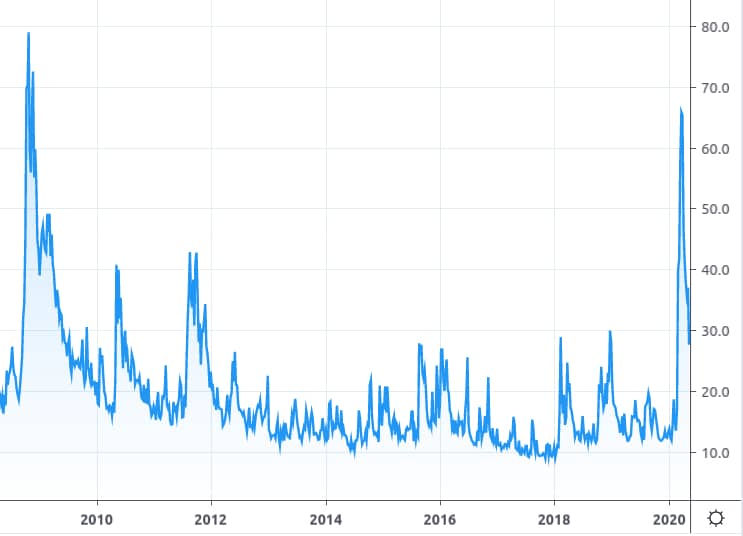

Let’s look at a brief example to clarify this. The following chart is the price chart of CBOE’s Volatility Index (VIX). This index tracks the implied volatility of the S&P500 options.

As you can see, VIX’s chart looks nothing like your standard stock chart. Once in a while, it has significant price spikes followed by big price drops back down to ‘normal’ levels. This is very typical behavior for volatility-related products. One possible strategy would be to take advantage of this mean-reverting behavior by selling volatility after each of these spikes.

Usually, however, you won’t be able to just sell volatility as you would short sell a stock. Instead, you could gain negative volatility exposure by selling options. But besides giving you exposure to implied volatility, options also give you exposure to price changes in the underlying asset. In other words, options come with unwanted directional risk. Delta hedging is one way to reduce this directional risk and thereby increase the pureness of the option seller’s volatility exposure.

If you want to learn more about selling volatility for a profit, make sure to check out my free options trading courses.

Hopefully, this example shows how Delta hedging a position can be advantageous in certain scenarios. Besides trying to fully eliminate the directional risk of a position, you can also use Delta hedging to reduce your directional risk to some more desirable level.

Gamma Hedging & Theta Hedging

In similar fashion to Delta hedging, you can also apply this concept to other Greeks such as Gamma or Theta. Instead of offsetting the directional risk of a position, you can offset Gamma or Theta risk.

Since a stock position is not directly affected by changes in implied volatility or time, you can’t use shares of the underlying asset for Theta or Gamma hedging. Instead, you will have to find other options positions that offset your Gamma or Theta. Since all Greeks are dynamic and thus change on a constant basis, Theta and Gamma hedging can become quite complex. That’s why I won’t cover this topic in detail here.

The simplest and most common form of Gamma hedging is simply the act of re-adjusting your Delta hedge.

Conclusion

Delta hedging is a good risk management tool that can help you reduce the directional risk of your positions and portfolio. One advantage of doing this is that it allows you to focus on other market aspects such as implied volatility or time decay. With that being said, it is important to understand that Delta hedging is not entirely foolproof.

One shortcoming of Delta hedging is that it does not protect you against overnight price gaps in an unwanted direction. Furthermore, you will have to make a tradeoff between the frequency of re-adjusting your Delta hedge and the quality of your hedge. The more often you adjust the hedge, the better its protection will be. But this comes with increased transaction costs as well as substantially more effort.

I hope you enjoyed this article on Delta hedging. Make sure to post any questions or comments in the comment section below.

Heloooo There, I really want to say a big thanks to you for putting up this informative and insightful article on delta hedging. This is really educational.. I actually heard about delta hedging from a friend but never really understood what it was all about or what it does, but seeing this article has really opened my eyes to what delta hedging is all about. I really find it interesting. Nice piece.

I am glad that my article clarified the topic.

Your article was very helpful in explaining Delta hedging. I was a bit confused about it before, but your explanation was very helpful and the diagrams/charts helped pull it all together. Some of these terms get confusing and it helps to have someone capable of putting into plain English. Thank you for doing that.

Do you think the current pandemic will change any of this?

Hi Diane,

Thanks for your comment. Delta hedging can work in any market, but due to the current high level of volatility, an increase in the frequency of adjustments might be warranted.

As Delta Hedging is something I had only heard about, your description was thorough enough that I understand somewhat what you are sharing. I do think that learning what needs to be adjusted and when might require a couple more read-throughs for me. Hedging is helpful but also requires close watching. This seems a method that could help the trader manage their funds with the movement of the market. My hedging skills are just now being acquired, and have only had a couple of trades that were hedged. Both were in the futures market. The moves are similar, but the descriptive terms that I have learned are a bit different. Thanks for the information,

helllooo dear, wow what an amazing post you have here. I first heard about Delta hedging a few weeks ago, but haven’t really understood what it means until now. Your article does a great job explaining the topic.

Thanks for this post and all this free content in general.

Keep up the great work!

Thanks for the positive feedback.

Before using real money, it will be ideal to try out a new investment on delta hedging strategy. Thank you for dedicating your time and effort coming up with such informative article.

your website certainly does help readers make wise business decisions. I will surely do some recommendations to some friends and family.

What are you trying to accomplish with delta hedging? Are you trying to capture the premium?

The goal of delta hedging is to reduce or eliminate the directional exposure of a position. In other words, we don’t want our position to be influenced by changes in the underlying asset’s price. This means we want to profit from something else. Usually, the focus will be on changes in volatility or time.

I hope this clarifies it. Otherwise, let me know.

Hi Louis,

I have gone thru your Delta Hedging and found it very useful. To be honest so far It has not gone to my head at all. I am going thru it again and again hoping it will make sense to me next time. Its me only who is taking time to understand it. I think since I am totally new to options trading thats why I am not getting it quickly. I will keep reading it till it start making sense to me.

I can not thank you enough for teaching options trading in such a nice way.

Hi Harry,

Thank you for your comment. It is totally understandable that you don’t fully understand Delta hedging after one read. Delta hedging is a relatively advanced options trading concept, so if you are new to options, you might want to focus on more basic stuff and revisit this page once you have fully mastered those.