Strangles are another quite popular strategy suitable for bigger accounts. They are the either undefined risk or undefined profit correspondent to an iron condor and are used in similar ways. But they have a greater profit potential. There are two types of strangles which I will present to you below:

Short Strangle Options Strategy

Market Assumption:

When trading a short strangle, you should have a neutral/range bound market assumption. By moving the short strangle up or down you can make it neutral with slight directional tilt. But generally a short strangle is a neutral strategy. Short strangles can be rather tight or very wide depending on which strikes you choose. If you decide to choose further out strikes, you will give up some of your profit potential but will get a higher chance of making money. This is also the reason why this is one of the best undefined risk strategies for high probability trading.

Setup:

- Sell 1 OTM Put

- Sell 1 OTM Call

This should result in a credit (You get paid to open)

Profit and Loss:

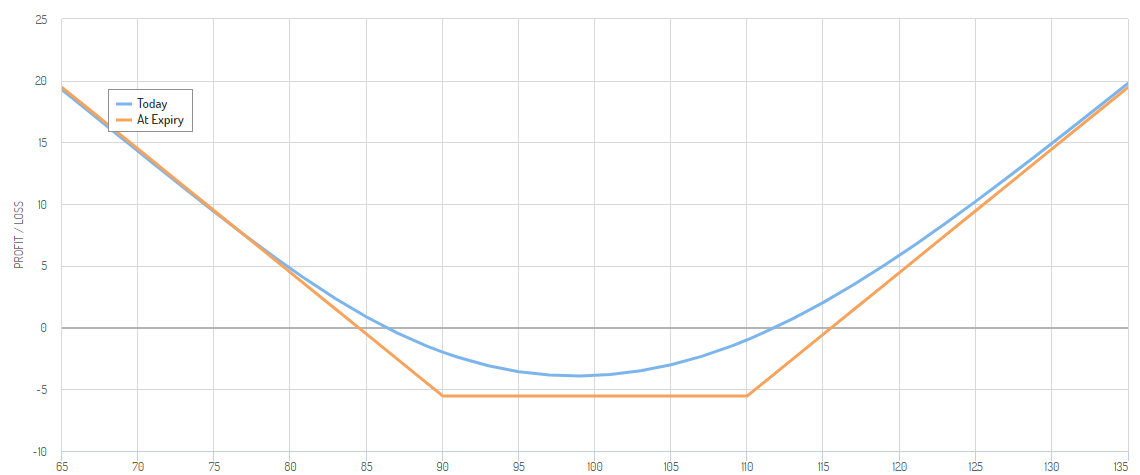

As seen on the payoff diagram a short strangle has unlimited risk and limited profit. The only differences between a short strangle and a short iron condor are the two long legs added for protection on each side of an iron condor. These are missing on a strangle and therefore it has unlimited risk, but also a higher profit potential. The maximum profit is achieved when the price of the underlying security stays between the two strikes. The break-even points are a little further out. The tighter a short strangle is the higher the profit potential becomes. But with that the probability of winning sinks.

Maximum Profit: Premium received – Commissions

Maximum Loss: N/A (unlimited)

Implied Volatility and Time Decay:

This short strategy profits from a drop in implied volatility and should, therefore, be used in times of high IV (IV rank over 50). This will increase the premium taken in and increase the chances of making money.

Since this is a short strategy Theta (time decay) is positive and works in favor of it. This means that the sold options lose some of their extrinsic value over time and thus increases the chances of winning over time.

Long Strangle Options Strategy

Market Assumption:

A long strangle is very similar to a long iron condor. This means the market assumption should be more or less the same when trading one of these strategies. You should be expecting some form of bigger move, but unsure in which direction, in the near future when trading these strategies. The further you go OTM with this strategy the bigger the expected move has to be.

Setup:

- Buy 1 OTM Call

- Buy 1 OTM Put

This should result in a debit (Pay to open)

Profit and Loss:

This is a defined risk, but unlimited profit strategy. The maximum loss occurs when the price of the underlying asset either stays the same or doesn’t move enough. The further you go OTM with the strikes the lower your max loss becomes. But this also reduces the chances of making money since the price of the underlying has to move even further. The profit rises the more the price of the underlying surpasses a break-even point.

Maximum Profit: N/A (unlimited)

Maximum Loss: Premium paid to open + Commissions

Implied Volatility and Time Decay:

A long strangle is most suitable for a low implied volatility environment (IV rank under 50) since it profits from a rise in IV.

Theta (time decay) is negative for this strategy hence time decay works against a holder of it. The long options lose a little of their extrinsic value over time. The more time goes by, the bigger each loss from time decay becomes.

The Best Tool to Learn Options Strategies

If you want to learn much more about hundreds of options strategies, I highly recommend checking out The Strategy Lab. The Strategy Lab is a tool designed to help traders understand options strategies, options pricing and the options market in general.

Interesting… I had ventured a little into the basic puts and calls in trading. I took a course last year that open my eyes that this trading can be done without too much risk. I had not delved into more sophisticated trading techniques due to lack of knowledge. This article makes me at ease about this trading strategy and its viability. Thank you for sharing your knowledge!

Hey Liliana,

I am so glad that you are enjoying my content. I hope you’ll learn a lot about options here.

Selling strangles requires a big margin account and approval from the trading platform to sell strangles, straddles and naked options in my platform TOS they show illegal shares and the order is rejected.

Thanks for the comment.

Strangles are an undefined risk strategy thus they require a margin account. Tastyworks allows you to use margin when you deposit more than $2000. I don’t know how this is for TOS. I would guess that you don’t have margin privileges and therefore, you have an error. But as I said, I don’t know for sure. Therefore, I recommend contacting TOS support.