99% of actively managed US equity funds have underperformed their respective benchmark. If wall street professionals with decades of experience fail to beat the market, what chances does that leave retail investors such as you and me?

If we can draw one conclusion from this statistic, it is that consistently beating the market is very hard. Therefore, most people would be much better off if they simply invested in the market itself instead of any alternative. In this post, you will learn exactly how to do this and much more. Keep reading until the end where I will present 10 of the best index funds for you to invest in today.

Why You Should Invest in Index Funds

Let’s start by discussing the pros and cons of passive index fund investing. The first advantage of index funds is that they don’t try to actively manage a portfolio with the goal of achieving the highest possible return. Instead, they aim to copy an index as closely as possible. The reason why this is good is that the vast majority of actively managed funds fail to outperform their benchmark. This means that buying the benchmark often leads to better returns than buying an actively managed fund or trying to actively trade yourself.

Next up, index fund investing is incredibly easy. Managing a well-diversified portfolio of investments can be very tedious and time-consuming. A simple way to create a well-diversified portfolio is by buying the entire market. Then you are almost guaranteed to always have at least a few stocks that perform well to balance out losses from other holdings. Sadly, buying the entire market requires a lot of buying power though. Due to many investors, index funds have this buying power and can therefore give you the opportunity to invest in the entire market for a fraction of the actual cost.

Furthermore, compared to other funds, index funds usually have very low expense ratios. In my opinion, one of the biggest drawdowns of normal funds is their high fees. For index funds, the fees you pay to invest with them are often negligible. Some index funds have even gone as far as to entirely remove their fees.

Otherwise, it is also possible to automatically invest a certain amount of your capital into an index fund. Instead of having to manually find stocks to trade and then sending trade orders, you can simply automate your investment process.

Last but not least, you don’t need to have a deep understanding of the markets to invest in index funds. In my opinion, you shouldn’t be trying to actively manage your own investment portfolio without having a deep understanding of the market structure, the companies you are investing in, and the trading vehicles you use to invest. Learning this obviously takes a lot of time which many people aren’t willing to put in. Therefore, index funds are a great time-saving alternative.

“By periodically investing in an index fund, the know-nothing investor can actually outperform most investment professionals. Paradoxically, when ‘dumb’ money acknowledges its limitations, it ceases to be dumb.”

Warren Buffet

Now that we have talked about some of the advantages of index funds, let us briefly talk about their disadvantages compared to other investments.

Firstly, index funds managers have much less flexibility with their investment style than other fund managers since their job is to simply copy a market index. In times of high volatility and falling prices, this can sometimes lead to undesirable outcomes. Nevertheless, in the long run, index funds typically outperform active investment funds.

In general, index funds can sometimes be quite volatile and prone to big dips especially during bear markets. Therefore, it is very important to have a long-term approach when investing in index funds. But more on this later.

Is Active Trading Dead?

Due to trading gurus and marketers, many people have built up unrealistic expectations about what returns are possible to achieve. I am not saying that it is impossible to get rich by swing trading stocks or Forex, but it just is extremely hard. In fact, it is so hard that over 90% of active retail traders don’t manage to be profitable – let alone consistently beat the market while taking a similar level of risk.

To put some data on this, a team of researches studied the returns of new individual day traders in the Brazilian equity futures market between 2013 and 2015. They found that 97% of traders that kept at it for over 300 days lost money, and only 1.1% managed to earn more than the Brazilian minimum wage ($3,965.96). Here is the conclusion of their paper:

We show that it is virtually impossible for an individual to day trade for a living, contrary to what brokerage specialists and course providers often claim.

Fernando Chague, Rodrigo De-Losso , Bruno Giovannetti

Just like with all high-paying professions, active trading takes years of hard work, dedication, and some luck to master. Most people just aren’t able to ever get to a point with their trading so that they can consistently beat the market.

That’s why I’d say that passive index fund investing is one of the best ways for the general population to get into investing. If you still want to actively trade as well, you can obviously still do that. But putting a portion of investment capital into an index fund certainly isn’t a bad idea. In my opinion, it only makes sense to invest more in your own trading than in an index fund if you are consistently beating the risk-adjusted market returns.

The Best Index Fund Investing Strategy

Now that we have covered why you should invest in an index fund, let’s talk about the best way to actually do so. Since you aren’t actively trading anything, there isn’t a complex investment system to follow. Nevertheless, there are a few things to be aware of.

First and foremost, it is essential to approach index fund investing as a long term endeavor. This means you don’t have to check your position every day, or even week. Short term price swings simply aren’t very relevant if you are in it for the long run. But this also means that you should only use money for these investments that you don’t need for anything else. You should not invest any money that you might need in the short term future. Always have more than enough money available elsewhere to cover any potential emergencies. Otherwise, you might be forced to sell your index fund investment right at or near a market bottom.

Next up, you should continually contribute to your investment and thereby dollar-cost average into the position. A good way to do this is to automatically invest a certain percentage of your disposable income every month. To make this very easy, most funds offer a service that allows you to automatically invest a certain amount each month.

Last but not least, you should start as young as possible. The real power of passive index fund investing is the compounded returns. The more time you have, the more favorable these returns will become. To illustrate the potential of long term index fund investing and compounded returns, check out the following chart. With a monthly contribution of $300, an annual return of 10%, and 30 years, you can turn an initial investment of only $10000 into over $750 000. Note that this is with an annual compound frequency which is quite low. (The x-axis represents the number of years.)

{{CODEcompounding}}

Try entering your own values here to see what potential returns you can expect.

The Best Index Funds

There are index funds for pretty much every sector of the market. Here are the main aspects you can use to differentiate between different index funds.

- Asset Class: How does the index fund invest? Examples include equities, currencies, bonds, commodities…

- Location: Where does the index fund invest? There are index funds for almost any country. Some funds also focus on multiple countries at once. The biggest and safest funds will typically focus on the US.

- Industry: Which sector does the index fund invest in? Some funds focus on technology stocks, others on financial companies, or on the entire market, etc.

Depending on these factors, certain index funds are more aggressive than others. For instance, an index fund that focuses on small-cap stocks or emerging markets will typically be riskier than a US large-cap stock or treasury bond index. Depending on your age, financial situation, and risk tolerance, you should therefore focus on a fund that suits your profile.

Instead of investing in an index mutual fund, it is also possible to invest in an index-tracking exchange-traded fund (ETF). ETFs trade on an actual exchange which makes the investment process very similar to buying a stock. Typically, ETFs will offer better liquidity since they are openly traded. However, as long as you plan on holding your position for a long time, this isn’t very important. Just like index mutual funds, ETFs typically also offer very low expense ratios and fees.

Unlike mutual funds, however, you can’t easily set up automated investing with ETFs. This means you will normally have to manually send out trade orders if you want to contribute to your investment on a monthly basis.

Some index mutual funds have minimum investment requirements. Sometimes, this can be as high as several thousand dollars. ETFs, on the other hand, don’t have minimum investment restrictions. As long as you have enough to purchase at least one share of an ETF, you can invest in it.

With that being said, here is a brief list of some of the best index funds to invest in.

| Name | Expense Ratio | Minimum Investment | 5 / 10 Year Annual Return | Type |

| Fidelity ZERO Large Cap Index (FNILX) | 0% | $0 | Inception in 2018 | S&P500 |

| Fidelity ZERO International Index (FZILX) | 0% | $0 | Inception in 2018 | International |

| Fidelity ZERO Total Market Index (FZROX) | 0% | $0 | Inception in 2018 | Total US Stock Market |

| Schwab S&P500 Index (SWPPX) | 0.02% | $0 | 13.52% / 13.37% | S&P500 |

| Schwab Total Stock Market Index (SWTSX) | 0.03% | $0 | 12.93% / 13.12% | Total US Stock Market |

| Vanguard Total Stock Market Index (VTSAX) | 0.04% | $3000 | 13.04% / 13.21% | Total US Stock Market |

| Vanguard Total Stock Market ETF (VTI) | 0.03% | Price of 1 Share | 13.02% / 13.22% | Total US Stock Market |

| Vanguard S&P 500 ETF (VOO) | 0.03% | Price of 1 Share | 13.54% / 13.42% | S&P500 |

| iShares Core S&P 500 ETF (IVV) | 0.03% | Price of 1 Share | 13.54% / 13.40% | S&P500 |

| SPDR S&P 500 ETF Trust (SPY) | 0.095% | Price of 1 Share | 13.48% / 13.34% | S&P500 |

As an example, an expense ratio of 0.05% means that you will have to pay $5 for every $10000 invested in the fund. As you can see, the annualized returns of these funds are all very similar. That’s because they are all copying the same index (total stock market, S&P500, or international).

Note that the just-mentioned funds are just some examples of a few great mainly US-based equity index funds. Obviously, there are many more that focus on other aspects of the markets. For instance, there also are US bond market funds, European funds, emerging market funds, and many more. But for most people that want the easiest solution, you certainly can’t go wrong with one of the above-mentioned funds.

Also note that past performance is not necessarily indicative of future returns, especially considering that at the time of writing this, we are near all-time highs (trailing annualized returns as of Sep 25, 2020). For reference, SPY has achieved an average annual return of about 9% since its inception in 1993. Historically, big index funds usually have managed to copy their respective index within 0.1% of the actual performance.

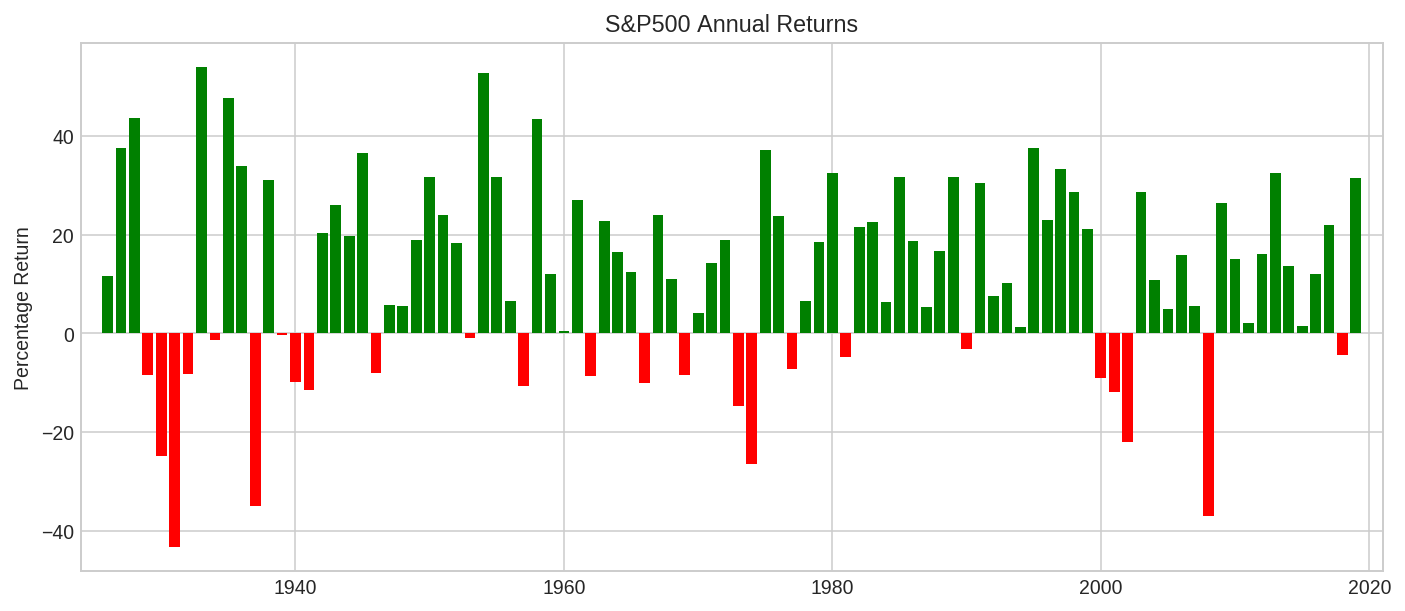

The following chart illustrates S&P500’s annual returns since 1926:

Conclusion

If there is one thing I want you to take away from this article, then it is not that active trading does not work. It is definitely possible to achieve substantial returns by actively trading the markets. The main point of this article just is that statistically speaking, most people are much better off investing in index funds than trying to actively trade their money themselves.

Historically, index funds have delivered great returns that are very hard to beat – even for professional money managers. Probably the most important ingredient of an index investing approach is patience. You should not expect too much within a couple of years. The real power of index fund investing or any successful investment style are the ever-increasing compounded returns.

With that being said, I’d say that learning how to actively trade is still a worthwhile endeavor. It is just important to focus on the actual learning process. Just because you spent a few weeks or even months reading about different investing approaches does not mean that you can become a successful stock picker. You should not immediately base your entire investment approach on the few things you learned online. Use a very small amount to experiment with. Only if your own trading is consistently outperforming the markets, you should start considering putting more money into it.

I really hope you enjoyed reading this post about index fund investing. Make sure to let me know if you have any questions or comments.

Hello Louis, thanks for sharing this article. I really like this because people have been really looking into trading online and usually there are so many fake and unrealistic promises. It’s really not easy to trade profitably because there are so many very poorly developed systems. I’m really happy to see an honest and simple approach like index fund investing.

Thank you for the positive feedback.

Hello Louis! Thank you for sharing this with me, I am sure this will create a foundation for people like me who’s planning on Investing in index mutual funds and ETFs as it gets a lot of positive press, and rightly.

Index funds, at their best, offer a low-cost way for investors to track popular stock and bond market indexes and I’m sure in many cases index funds outperform the majority of actively managed mutual funds.

Thanks for the comment. I am glad you liked it.

Hello there always much appreciated for ur info

what about investing bond what would be the best bond investment and how do i invest ? can i buy or invest the way i buy stocks via regular brokers? just wondering this would be good for being diversified investment to buy any safe bond

Hi Bronson,

You can either buy bonds directly or invest in a bond fund. To learn how bonds work, and how to invest with them, make sure to check out my guide to bonds investing. I hope this helps.

Hi Louis,

Again very useful and educational article. I wish I had read it few yrs ago. I could have saved lots of money which I lost in trading Penny Stocks without doing my homework. I guess we all learn by making mistakes in life.

I am really really enjoying reading all your articles and hopefully all these readings will help me in the long run when I decide to start trading.

Thanks

Harry

Hi Harry,

Thanks again for the positive feedback!