Penny stocks are very low priced stocks that often only trade for pennies just like the name implies. These stocks are one of the most hated investment assets in finance. They are rarely featured on any financial news networks and are always classified as ‘too risky’. In this article, I will try to discuss if penny stocks deserve their hate or are good opportunities.

What is a Penny Stock:

There are different definitions of ‘penny stocks’. One widely agreed upon definition for a penny stock is a stock trading below $5 a share. But it is hard to pinpoint one exact definition as these stocks often move back and forth between different price ranges. There are stocks trading for fractions of pennies whereas others trade up to ten Dollars or sometimes even temporarily higher. Companies with penny stocks usually are companies with a low market capitalization, only little revenue and generally only a few fundamentals. The market cap averages somewhere around a few Million to 500 Million USD. This may seem like a lot but it actually isn’t compared to most other successful companies.

These stocks normally don’t trade on any major exchanges, but more on that further down.

Pros and Cons of Penny Stocks:

Penny stocks actually have some advantages. But you will practically never hear of these in any mainstream financial media as the majority of them looks down upon penny stocks.

Pros:

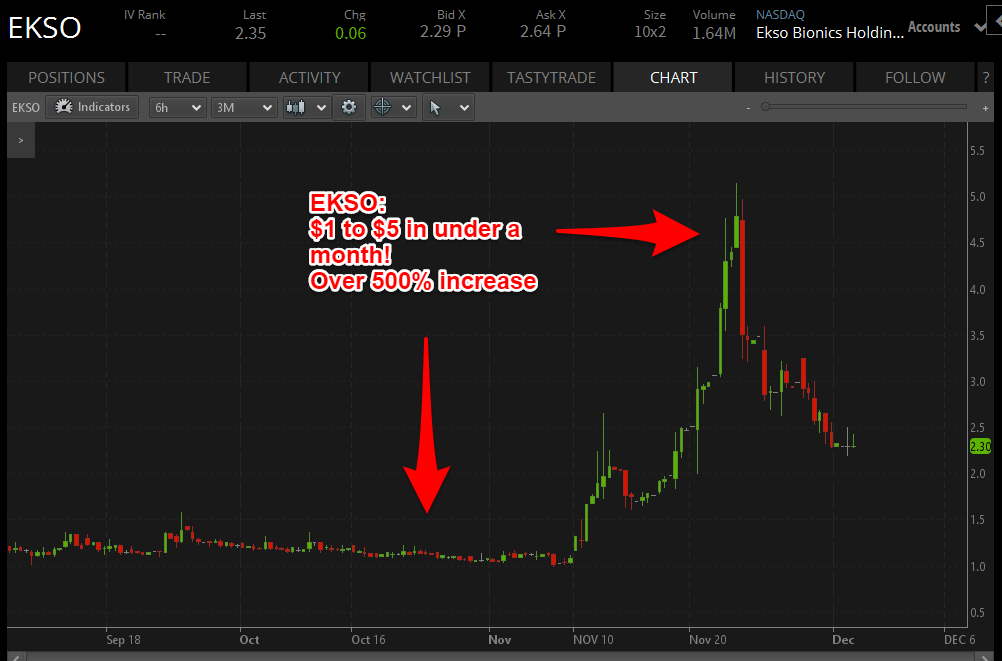

- Volatility: One of the biggest advantages of penny stocks over ‘real’, higher priced stocks is the increased volatility. There are much higher price swing in penny stocks than in other stocks. This can be a good opportunity to make money. A penny stock that goes from $1 to $5 within a few days isn’t a rare occurrence in the land of penny stocks. I have never seen any higher priced stock do a similar increase of 500% in such a short time frame.

- Price: Apart from the added volatility, comes the very low price. This is an advantage in that sense that everybody can afford to buy a lot of shares. To make good money with stocks, you usually have yo buy/(short) a good enough amount. The problem is that many stocks trade for ca. $150 and they don’t even move that much. To buy 100 shares, you would have to allocate $15 000 of your money. That is a lot of money for one position! Even with that investment, you would only make $100 for a $1 move in your direction.

As penny stocks trade for Pennies or a few Dollars, most people can’t only afford to buy 100 shares, but thousands of shares. - Lack of information: Even though it sounds like something bad, lack of information can be a big pro. The penny stock market is relatively inefficient meaning that information often takes time to spread. This can be a good opportunity to profit. Higher priced stocks of very well known companies often have millions of ‘followers’. This means new news on that company will be priced in the stock price immediately as thousands of people look at this news instantaneously. Some funds, banks etc. get to know the new information before the general public even has a chance to find out.

With these circumstances, it can be very hard to gain an edge. But as penny stocks don’t have millions of ‘followers’, it is possible to find new information about the company that is not yet priced into the stock price.

Here are some just two examples of the ‘insane’ volatility in some penny stocks:

These two examples aren’t even exceptions. I literally just chose two random stocks from one of my watchlists.

Cons:

As good as all this may sound, penny stocks do also have a lot of disadvantages and these are the things that make them so hated.

- Lack of liquidity: Most penny stocks are very thinly traded and only have a few hundred to thousand shares traded daily. This makes the majority of penny stocks useless as this just is too low volume. Don’t even bother trying to trade penny stocks with this kind of volume. It is very hard to open and more importantly to close positions in assets with so low volume. Luckily, there are exceptions and there often are volume spikes meaning that more people trade penny stocks. This is usually the case when new good news comes out. This is also the time when the stock prices tend to rise exponentially. In these times some penny stocks trade millions of shares daily. (To learn more about the importance of liquidity, click HERE).

- Bid/Ask Spread: With the lack of liquidity come very bad, wide spreads, meaning that you have to pay more when buying and get paid less when selling. Spreads on very illiquid penny stocks often go up to one Dollar or more. This is very bad when you consider that the stock price only is a few Dollars.

- Manipulation: Another reason why many people shy away from penny stocks is the manipulation. There are a lot of artificial price movements in the world of penny stocks. One very common manipulation scheme is the so-called ‘pump and dump’ scheme. But more on that in a moment.

- Lack of Regulation: Penny stock companies aren’t regulated nearly as much as companies with higher priced stocks. This is also the reason why there is so much manipulation and other sketchy price movements. Many press releases and other statements from the company are extremely exaggerated.

- Not Optionable: Another minor disadvantage of penny stocks is that they are not optionable meaning that you can’t trade options on them. But this wouldn’t make sense anyway due to the severe lack of liquidity.

Summed up, there are both advantages and disadvantages. There obviously are risks and I don’t think penny stocks should be considered a good investment asset as a whole. But there are better penny stocks than others. Furthermore, there are times where some penny stocks are better than in other times. For example in times of new news and high volume.

What is a Pump and Dump:

You may know this kind of stock manipulation from movies like ‘The Wolf of Wallstreet’ or the ‘Boiler Room’ in which these promoters call thousands of potential investors and thus artificially push the stock prices up. A ‘pump and dump’ is a scheme where insiders buy shares and then begin to promote that stock (‘pump’). After the stock price is up enough, they sell their positions and ‘dump’ the stock. After the promotions stop, the stock price starts falling and all the investors that bought the stock due to the promotions want to sell their shares. This leads to a massive collapse in the stock prices and most investors lose a lot of money.

Nowadays the stocks aren’t promoted per phone calls anymore. The promoters team up with some mailing services that have a huge outreach. These send out thousands if not even millions of emails telling everyone how great this stock is. Even if the people don’t believe the content of the mail the first time, they may hop onboard after they see the stock price increase a lot because of the manipulation.

Usually, the mailing services have to put a disclaimer somewhere saying that they got compensated by the company. If you see this anywhere, be aware! Generally, you shouldn’t believe anyone promoting a penny stock.

If you ever get an email telling you that a stock is the next Microsoft, chances are very high that it is not. The email is probably part of yet another pump and dump scheme.

What to look out for when Trading Penny Stocks:

- The big majority of penny stocks fail. Most of the companies aren’t good. There is a reason why these stocks trade for so little and that is because they really are that bad. So please don’t buy any penny stocks thinking that they will be the next Microsoft and you will become rich of it. No matter how positive all the news might seem. The odds are stacked against you. You have to be very skeptical when it comes to penny stocks. There is so much manipulation, exaggeration and more. So don’t believe anything.

Even if a company actually has really good news like good earnings, the stock price effect will mostly only be temporary. You can profit from the rise, but don’t hold the stock forever as it probably will come back down again. - Instead of reading press releases or other news reports, look at the SEC filings. These are legal filings and you can’t exaggerate or even lie in these legal filings. I know these can be hard to read, especially if you know nothing about them, but they are sadly one of the only sources you can trust when it comes to penny stocks.

You can also find a company’s fundamentals in these filings. Look at the fundamentals. Often penny stocks barely have any fundamentals. You should find a lot of ‘companies’ with a lot of debt, no revenue… when you look at penny stocks.

Who Trades Penny Stocks:

When it comes to ‘competitors’ or other traders, penny stocks are quite unique. There are barely any institutional traders like hedge funds, banks or other funds in penny stocks. This is mainly due to the lack of volume and liquidity. These traders manage millions or even billions of Dollars. Firstly, they can’t trade in large enough quantities to even make it worth it due to the lack of liquidity. Additionally, they would influence the stock price way too much. If a stock usually trades a few thousand shares a day and one trader sends out a buy order for ten million shares, the stock price will rise. This is a bad thing as you don’t want to affect the stock price so much yourself.

Institutional investors therefore rarely even consider penny stocks. But there are a few seldom occurrences where these investors invest in these companies. Usually, they will receive a special discount price though and that tends to impact the stock price quite negatively.

Mainly retail traders like you and me are the ones trading penny stocks. Otherwise, there are the so-called insiders. These insiders often take part in stock price manipulation and use this as a profit opportunity.

As you can see, penny stock trading is a special niche with only relatively few participants. This may seem like something bad but actually, it can be seen as an advantage as well. Other traders can be seen as competitors and obviously, you would rather have other retail traders as competitors than huge institutional investors. You won’t have to bother with these huge funds/banks… with ‘unfair’ advantages in the world of penny stocks. But beware of stock manipulators.

Where do Penny Stocks Trade:

Penny stocks mainly trade on three different ‘exchanges’:

- Nasdaq (Small Cap): Nasdaq (Small Cap) is probably the best exchange for penny stocks. As Nasdaq has certain minimum requirements for stocks, the penny stocks found there will mostly trade for a few Dollars instead of a few pennies. But that’s not necessarily a bad thing.

- OTC Bulletin Boards (OTCBB): This is another ‘good’ place to find penny stocks. As far as I am concerned there aren’t any minimum requirements for stocks to trade here, so a lot of very cheap and sketchy companies trade here.

- Pink Sheets: Many penny stocks trade here. Pink Sheets don’t have any minimum requirements and barely any regulations. Therefore, this is usually where the sketchiest and worst companies trade.

Be careful with all these ‘exchanges’ as generally, many penny stocks are very sketchy. I personally would recommend sticking to Nasdaq stocks (and sometimes OTCBB). But try to avoid the Pink Sheets as these really usually have no volume, regulation…

Where to Trade Penny Stocks – Do You need a Special Broker:

Many people (including me a few months ago) think that you need some sort of special penny stock broker to trade penny stocks. This isn’t the case. Practically any (good stock) broker will have penny stocks. Even my broker that focuses on options trading (Tastyworks) offers tons of penny stocks. These are just a few examples of brokers that offer penny stocks: E*trade, Tastyworks, Thinkorswim, Interactive Brokers, Suretrader…

You can check out my broker reviews, here!

Are Penny Stocks Good Investments:

In my opinion, this question can be answered with one word: NO! Penny stocks aren’t good investments at all. Statistically speaking the big majority of penny stocks stay penny stocks or even fail. Only a tiny fraction of these companies ever become ‘real companies’ with ‘real’ stocks. The odds really are stacked against you. Guess why penny stocks get so much hate and are never featured on any financial media? You should never invest in any one penny stock thinking it will become the next Microsoft. There is way too much exaggeration, lies, manipulation and other sketchy stuff to invest in penny stocks. Of course, there are exceptions but in trading, the odds should be working for you not against you.

But…

This doesn’t mean you can’t profit from penny stocks. They are one of the most volatile assets of them all and that is something traders love. You will hardly find near as much huge moves in any other stock sector. I have nothing against trading penny stocks for a short-term gain. This is a good strategy and a lot of traders have made a lot of money by doing this. Just try to keep things on a short-term basis as price increases in penny stocks always tend to be temporary.

One of the most important lessons for newcomers to penny stocks is to never believe anything! No matter how good a company may seem to be, there is probably a reason why it is trading for pennies or a few Dollars. The only sources you can trust are legal filings like SEC filings.

Hey Louis,

I’ve always been intrigued by penny stocks. I don’t get involved with them because of the risk. Your article can help people see the risks and then if they accept the risks can use the system that can help learn about penny stocks. This makes for a fair review, which I always appreciate. Many reviewers will highlight all the good and not speak much about the not-so-good.

Yours is a refreshing departure from that in that you write about how most penny stocks lose money, etc. Thanks for your review and I will check out what Tim Sykes is offering, even if it I don’t decide to trade penny stocks.

Best Regards,

Jim

Hey Jim,

Thanks for the comment. Very happy to hear that you enjoyed this article.

This is great information. You really break down some technical stuff and make it as interesting and palatable as I think one can. I have heard of the penny stock craze years ago. Good to know that it is not a fad or a scam.

Thanks for being honest and telling the pros and cons. Also glad to know that there is a sweet spot to make some money off of penny stocks. Nice site!

Thanks so much for the positive feedback.

I’ve often searched for education and information about how to trade penny stocks, and what to look for and what not to look for.

I found your post very informative and helpful! I’m even in the process of joining Tim Sykes to learn some more and test the waters some with some extra cash that I can afford to loose worst case scenario.

Do you have any books or other resources along with Tim Sykes that would help aid a new penny stock trader like myself? This stuff is fascinating to me!

Your article is greatly appreciated, thanks for the info!

Thanks for the great comment and the positive feedback. Honestly, I find Timothy Sykes video lessons and DVDs enough resources to become successful. It is just important to take your time and watch all the content thoroughly. A review of Tim Sykes and his products will come soon.

I enjoyed your article on penny stocks because it was informative, but stops short of giving too much information at once. My curiosity is fed, but it’s up to me to search through your site further to learn more. Another positive for your site is the wheel spin pop up that allows you another avenue for engagement. I think that I will be reading more on your site on options etc. so hat I can learn more. I also read your “options for beginners” article and I think that it is a little vague.

Thanks a lot for the feedback. I really appreciate it. I just have a question about your last comment. What article are you referring to? I have never written an article with the name “options for beginners”. Are you referring to my Options Beginner Course which is a short article/video lesson series?

Great read. I always see ads on trading options and penny stocks. I never understood the market so I never took them serious. But recently i joined one called roboforex. I have not made a deposit yet cause i want to learn first.

I appreciate this article. It helped me understand penny stocks more.

Happy to help.