Option Alpha offers an extensive technical analysis backtesting report. In it, you can find the results of the backtesting of 17.34 million stock trades over 20 years. The research revealed that about 95% of technical indicators failed to beat the market. Only a few managed to generate a considerable return. One specific indicator even beat the market by 2602%.

Sounds good as an advertisement. But is the report actually worth it?

I own the report and will present my view on it in the following Option Alpha Signals review.

What you will get

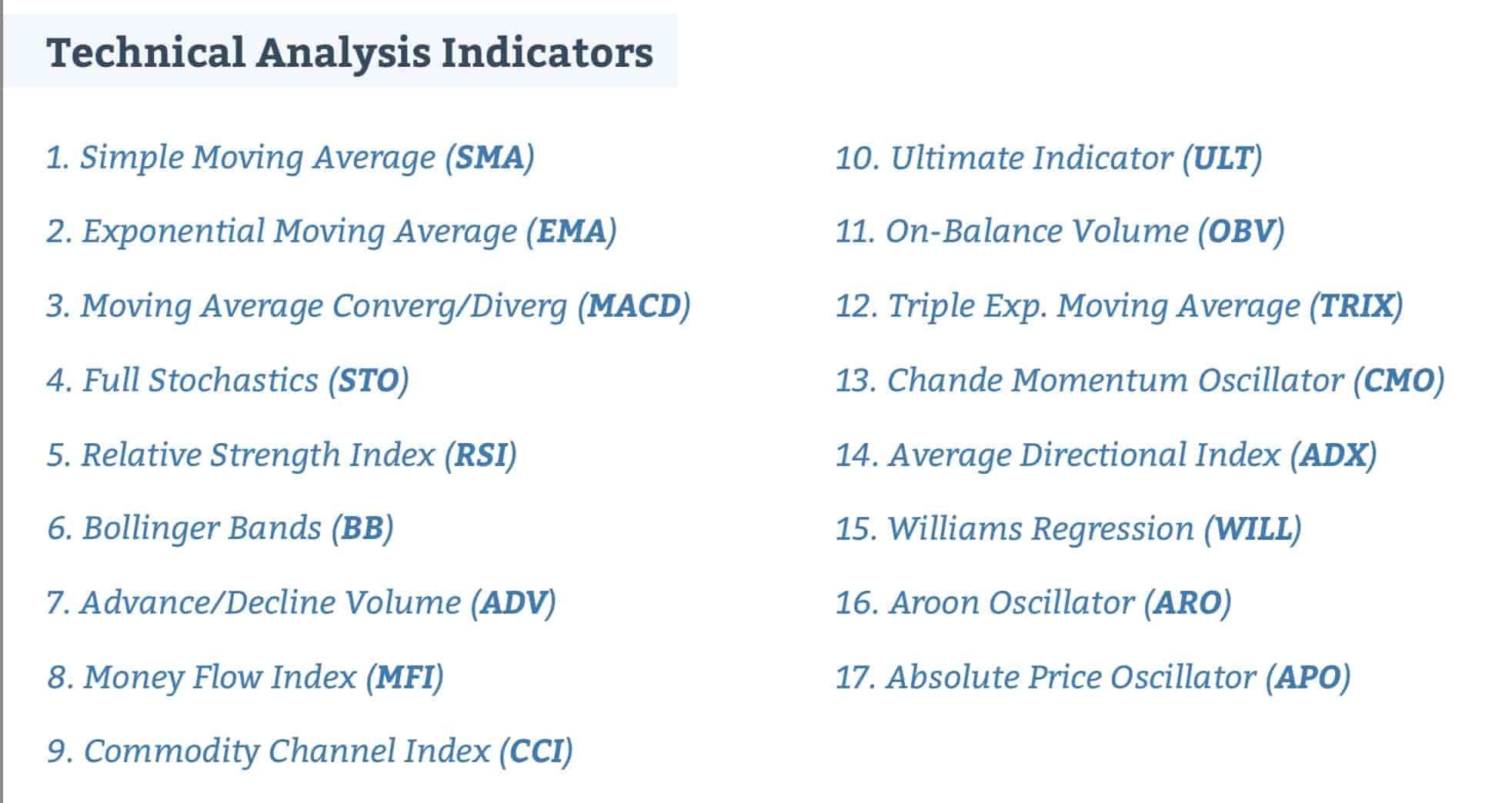

Option Alpha Signals report is all about technical analysis indicators and their reliability. Kirk and his team have backtested 17 different indicators with countless different settings over 20 years (more on the backtesting further down).

In the report’s introduction, Kirk states that the goal of this report was to answer the following three questions:

- Is Technical Analysis more reliable than randomly picking a stock’s direction?

- If so, can you generate excess returns above just holding SPY (Benchmark Index) on a consistent basis?

- If so, what are the specific indicators and settings that work best long-term?

As I have read the report, I can tell you the answers to all of these questions:

- Depends on the indicator

- Most indicators fail to beat the SPY

- Due to copyright, I can’t reveal this

Most people (including the mainstream financial media) just accept the reliability of technical indicators. But this research report actually reveals that technical indicators shouldn’t necessarily be trusted since most of them don’t work.

Furthermore, this report reveals that the few indicators that work, work because they are used very differently than most people use technical indicators. Most people use indicators for relatively short-term trading. However, the most profitable indicators were all longer-term indicators.

Generally, the Option Alpha Signals report reveals some very interesting data that is very eye-opening.

By buying the Signals report, you will gain access to 3 documents:

- The Signals Report: This is the report itself. In this 76-page long document, Kirk tells you about the backtesting, his opinion, some sample portfolios and more.

- The Top Settings: This 9-page long PDF shows the top settings for each indicator for different performance metrics. Furthermore, it reveals the best indicators and their settings for shorter-term and medium-term trades.

- The Appendix: This 222-page long document walks you through each indicator and all the different settings together with their performance and more.

By buying the report, you will have access to all future updates of this report. But I doubt that there will come any updates.

On the following image, you can see all of the backtested indicators:

Some flaws in the backtesting…

As you probably have realized by now, this research report reveals some shocking facts about technical indicators. But is Kirk’s backtesting actually translatable to real-world trading? Do we really use indicators like they were backtested?

I don’t believe that most people use technical indicators the same way as they were backtested. With that being said, I don’t think that the data found from Kirk’s research is invalid or useless.

I have four points of concern:

- Most people don’t solely rely on one technical indicator to make trades. Often other information such as fundamental factors, news, trend-lines or multiple indicators are used. The backtesting bases all trading decisions on a single indicator.

- All backtested trades are done as follows: buy when an indicator crosses a certain level and sell when the indicator crosses a different level. This is once again, not necessarily how most people would use technical indicators. The buy signal is fairly accurate. However, the vast majority of people don’t wait to sell their positions until an indicator crosses another level. Often people close positions earlier.

- Generally speaking, humans don’t tend to take profits or losses purely based on an indicator.

- Last but not least, the backtesting simulates 100% robotic, emotionless trading. No one trades like this. There is no human element factored in the backtesting. For instance, humans would be affected by market news, major events, and their emotions. All of this is not factored in.

I know it would be very hard to perform a backtest and factor in the just-mentioned aspects. But like I said, most people don’t solely rely on a single indicator to make trades.

Once again, I still think that the backtested data is valuable and gives great insights into the reliability of certain indicators. Furthermore, the amount of backtested trades (17M+) is very impressive.

How will it impact your trading?

Before you decide to buy (or not to buy) this report I just want to tell you what you should expect and what you shouldn’t expect from this report.

First of all, you should not expect your trading to blow up after buying this report. In general, this report will act more as an eye-opener than anything else.

Obviously, you can use the best performing indicators from this report for your own trading. But you shouldn’t base all your trading decisions on these indicators. You should still have an own trading strategy.

In my opinion, the impact that this report will have on you depends on your trading style. If you are using a lot of technical indicators for your trading, I think this report could help you more than if you aren’t using any technical indicators at all.

Furthermore, like I said above, most of the best indicators only work for longer-term trading and not for day trading strategies. If you only hold trades for a few seconds, minutes or hours, most indicators probably won’t help you too much.

Nevertheless, I think this report can act as an eye-opener for everyone, regardless of trading style.

Pricing

Let’s get into the pricing of the Option Alpha Signals report.

Apparently, the official price of this report is $297. However, there has been a ‘limited time offer’ of $197 for ages now.

I don’t think the price will go up to $297 anytime soon.

There are two ways to gain access to the Option Alpha Signals report. Either you buy it directly or you can gain access by buying an Option Alpha lifetime membership for $1997. To learn what else you can gain access to with the lifetime membership, make sure to check out my Option Alpha Review.

Conclusion – is it worth it?

To recap, I think the Option Alpha Signals report does reveal some very interesting information. However, it hasn’t really impacted my trading in a big way. But that is probably because I barely use any technical analysis for my options trading.

I think this report is especially useful for traders that actually use technical indicators for their trading.

Otherwise, you just have to ask yourself the question if you want to pay $197 to find out which indicators actually work and outperform the market. How valuable is this data to you?

I can’t tell you what to do because this really is a personal question.

Hopefully, you enjoyed this Option Alpha Signals review. If you aren’t sure if this report is something for you, I could try to help you if you tell me your situation in the comment section below.

If you want to learn about some other useful options trading resources, make sure to check out my options trading resource page!

Thank you for this review Louis!

There is soooo many trick offers out there that it is almost impossible to find real useful information on strategies that can work for trading anything nowadays.

I have read a few expensive books on technical analysis and have failed at consistently making money in trading stocks and some futures with their indicators.

Options sound interesting but there are also many expensive offers for the secret to success with options and its good to find honest reviews that discuss them.

Cheers!

Hey man,

Thanks so much for the comment. If you want to learn the hard truth about technical indicators I would really recommend Optionalpha’s ‘Signals’ report. You can find my review of it here.

Otherwise, if you want to learn more about option trading on my site and want to learn a consistently profitable strategy, you may want to check out my education on options here. It is 100% free.

Thanks for your Option Alpha signals review. I never put a lot of faith in reports like this. I definitely don’t have the stomach for day or short-term trading.

I tend to invest mainly in a couple of index funds for the long haul. I am sure the report is interesting and some one put a lot of time in it, but it’s all history and won’t predict the future, especially the way things are going.

I know markets run generally in patterns and most people have no clue when it comes to what it takes to guess when it will shift again.

Thanks for sharing your thoughts. It is true that the past isn’t necessarily indicative of the future. However, I still think that it is important to look at the past.